How Revolut Turned Referrals into a $4B Growth Machine

The Secret Growth Playbook Behind Revolut’s Viral Referrals

Hi everyone 👋

This week we’re unpacking Revolut’s viral growth machine. You’ll see how the company doubled its user base in two years, why 65% of new customers now come through referrals, and what makes its member-to-member loop both defensible and hard to copy. We’ll break down the exact flow, the levers behind it, and the lessons fintech builders can borrow.

What’s inside:

📈 Revolut’s latest growth and revenue numbers.

📣 How referral campaigns are promoted and timed.

📱 The step-by-step flow of a member-to-member referral.

🎚️ The levers that make it fraud-resistant and defensible.

📘 Practical lessons you can borrow for your own growth loop.

Let’s go!

Inside Revolut's Viral Growth Engine

Revolut is the talk of the town.

In Dubai, Revolut announced that they finally secured a license from the Central Bank of the UAE (Stored Value Facilities and Retail Payment Services Category II), roughly a year after I posted about their move into the Middle East:

🇦🇪 Revolut is coming to Dubai! Here's what every fintech and bank should know about this $45B giant

➡️ But the bigger story is about Revolut’s growth over the last 2 years.

The company has doubled its growth in the last two years and 65% of new retail customers are arriving via word-of-mouth referrals. Revolut is adding users at a rapid pace and converting them into spenders fast.

We’re going to break down its most important component:

A highly tuned, time-boxed member-to-member referral loop that turns friends into activated cardholders.

It’s measurable, defensible, and hard to copy without real product depth.

The latest numbers

52.5m customers by year‑end 2024 - almost 15m added in the year, and the total user base has doubled in the last two years alone.

Revenue up ~72% to $4.0bn - with strong contributions from card payments, FX, subscriptions, wealth, and interest.

Net profit ~$1.0bn; Profit Before Tax ~$1.4bn; fourth consecutive profitable year.

Customer balances ~$38bn; transaction volumes approaching $1.3tn.

65% of new retail customers came via word‑of‑mouth/referrals.

No vanity metrics here - acquisition is compounding, activation is high, and the unit economics support meaningful rewards without bleeding cash.

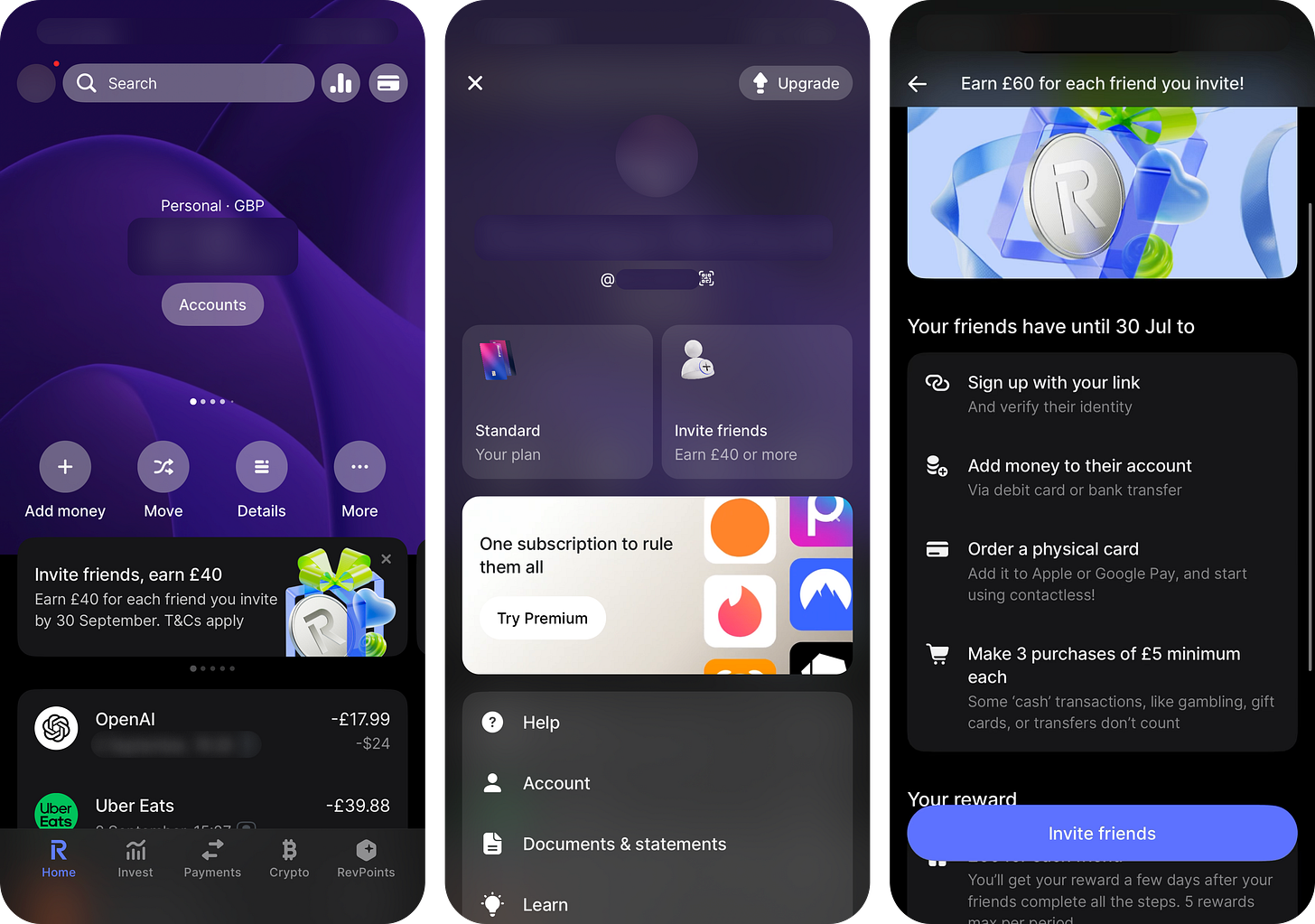

How the referral is promoted

A smart banner on the dashboard.

Push notifications timed to campaign milestones.

Emails that are relentlessly A/B tested.

In fact, I received over 46 referral emails in 2025 alone. They fall into a set pattern:

First email: “Earn £XX for each friend that joins Revolut” - simple and direct.

Follow-up email (12 days later): “Only X days left to earn £XX” - adds FOMO and urgency.

The cash amount in these emails is dynamic and fully synced with the app, banners, and notifications. Campaign emails are typically sent in 21‑day batches, with follow‑ups on day 12. Most drop on Thursdays at 8am, with some Tuesday sends - Revolut rarely deviates from these timings.

Back in 2019, the bonus was £6 each (referrer + referee). Today it’s a variable reward usually between £40 and £70 per referee, credited only to the referrer.

How the member‑to‑member referral works (typical flow)

Terms and cash amounts vary by country and campaign - the app always shows the live offer and deadline.

Open referral screen

This can be done from various places, either from the push notification, email, dashboard banner or by tapping on the profile. The referral screen automatically shows the live campaign, reward, rules, cap, and deadline.Referrer shares their unique link

Each user has a personalised referral URL, e.g. https://revolut.com/referral/?referral-code=xxxx.

Tap Invite to bring up your link and share via your preferred channel.

Note: Revolut can access the phone contacts (after granting permission)Invitee signs up (new to Revolut)

The referree must open a Personal account using the referrers link, complete KYC, and be a first‑time customer.Add money from an external source

A card top‑up, Apple/Google Pay, or bank transfer works. Transfers from another Revolut account don’t count.Order a physical card

Required for eligibility. This costs around £4.99 for the referee.Make 3 purchases of £5 each

The app shows the requirement and countdown. Certain categories (currency exchange, gambling, gift cards, P2P transfers) don’t count.Track progress in‑app

Each step ticks green as it’s completed. The referrer also receives real‑time push notifications whenever the referee completes a step, alongside a visible countdown.Get paid

When all steps are completed within the time limit, the reward is credited within 2 days (up to 5 business days) to the referrer’s Revolut balance. Most campaigns are one‑sided - only the referrer is paid.

No gimmicks here, the promised cash is added to the balance without any hidden terms or complex withdrawals journeys.

Campaign levers you’ll notice

Time‑boxed - clear deadline to create urgency.

Capped - a max number of paid invitees per campaign.

Variable rewards - usually £40-70, changing by market, time and other factors such as how much rewards were previously earned.

Eligibility checks - first‑time customers only, external top‑up, physical card ordered, legitimate purchases.

Referrer involvement - real‑time progress updates and countdowns encourage them to actively guide referees through the funnel.

Why this works so well

It pushes to real activation - sign‑up alone is worthless. Requiring a top‑up, physical card, and three purchases turns referrals into engaged customers.

Progress UI + real‑time notifications - the checklist removes ambiguity and creates urgency for both sides.

Trust compounds - a friend vouches for the product, then the first purchases and card arrival reinforce trust again. That’s two conversion moments, not one.

Referrer as buddy - because the referee gets no incentive, the referrer essentially “coaches” them through the steps to ensure completion.

Fraud‑resistant by design - excluding easy‑to‑game transactions and requiring first‑time users keeps CAC honest.

Flexible unit economics - variable rewards and country‑level settings let Revolut price acquisition to local LTV - while a diversified revenue mix means payback isn’t dependent on a single line.

Distribution everywhere - referral tile, push, email, banner. When 65% of new customers arrive via organic or referrals, every cohort seeds the next.

Modern architecture - the second a step is completed it reflects instantly in the referrer’s dashboard and notifies them. I’ve seen a 3rd payment update within one second.

What to borrow if you’re building this

Make results measurable - show a live checklist and when rewards will arrive.

Time‑box campaigns - urgency beats a perpetual trickle. Rotate creative and rewards by market.

Anchor on activation, not sign‑ups - require actions that correlate with value in your model.

Engineer defensibility - add fraud guardrails and a per‑campaign cap.

Price to LTV - let rewards flex by geography, segment, and seasonality.

Tell a story, then show a path - mix social proof with a visible next step from the home screen.

Leverage your architecture - instant progress updates make the loop feel rewarding and alive.

If this sparked ideas – or raised questions - I’d love to hear from you. Hit reply or DM me.

Until next time - Dom 👋

About Dom Monhardt, founder of one-fs.com

I am a French technologist and product leader living in Dubai, with 15+ years of experience in building cutting-edge and innovative digital experiences.

I am interested in the intersection of business, design, and technology and am deeply passionate about the fintech and digital banking world.