⚡️🏦 Pay By Bank is about to shake European payments | Meet Wero 🇪🇺

Some say it's the end of PayPal, others say Visa and Mastercard will take a big hit. Let's take a look at it!

It’s no secret - I’m bullish on Pay By Bank.

So much so that, back in January, I declared 2024 to be The Year of Pay By Bank.

And a lot has happened in this space this year:

➡️ Revolut Pay gets integrated on leading eCommerce websites

➡️ Truelayer launches VRBs (Pay By Bank Subscriptions)

➡️ Volt launches their Pay By Bank checkout, aiming to connect the 80 RTP networks available globally

➡️ UAE’s Aani launches a Pay By Bank solution connecting UAE’s major banks

➡️ Fintechs are building Pay By Bank on iPhones as Apple opens up NFC technology, paving the way for bank account payments at the point of sale

In case you missed them, check these onefs articles:

Wero has landed - Europe’s Pay By Bank solution.

This week, some big news came out of Europe - the launch of Wero, a Pay By Bank solution connecting 30+ banks across the continent.

Ok, so is this just another Venmo?

Wero is all about making instant payments, directly connected to your bank account(s).

Venmo (by PayPal) is a wallet app focused on peer-to-peer payments. So while you can achieve similar outcomes with both apps (paying people, bills, and businesses), the main difference lies in how it is done.

A small nuance with big impact.

Traditional wallet apps like Venmo need to be topped up using a bank card or by making bank transfers, which can take up to 5 days to complete. Card payments are faster but costly (either absorbed as an acquisition cost by the wallet or passed on to customers).

The main difference with Wero is that your bank account is directly connected (using SEPA rails). Technically, it is considered a pass-through digital wallet, as the money is transferred directly from point A to point B without needing a separate wallet balance (similar to Apple Pay).

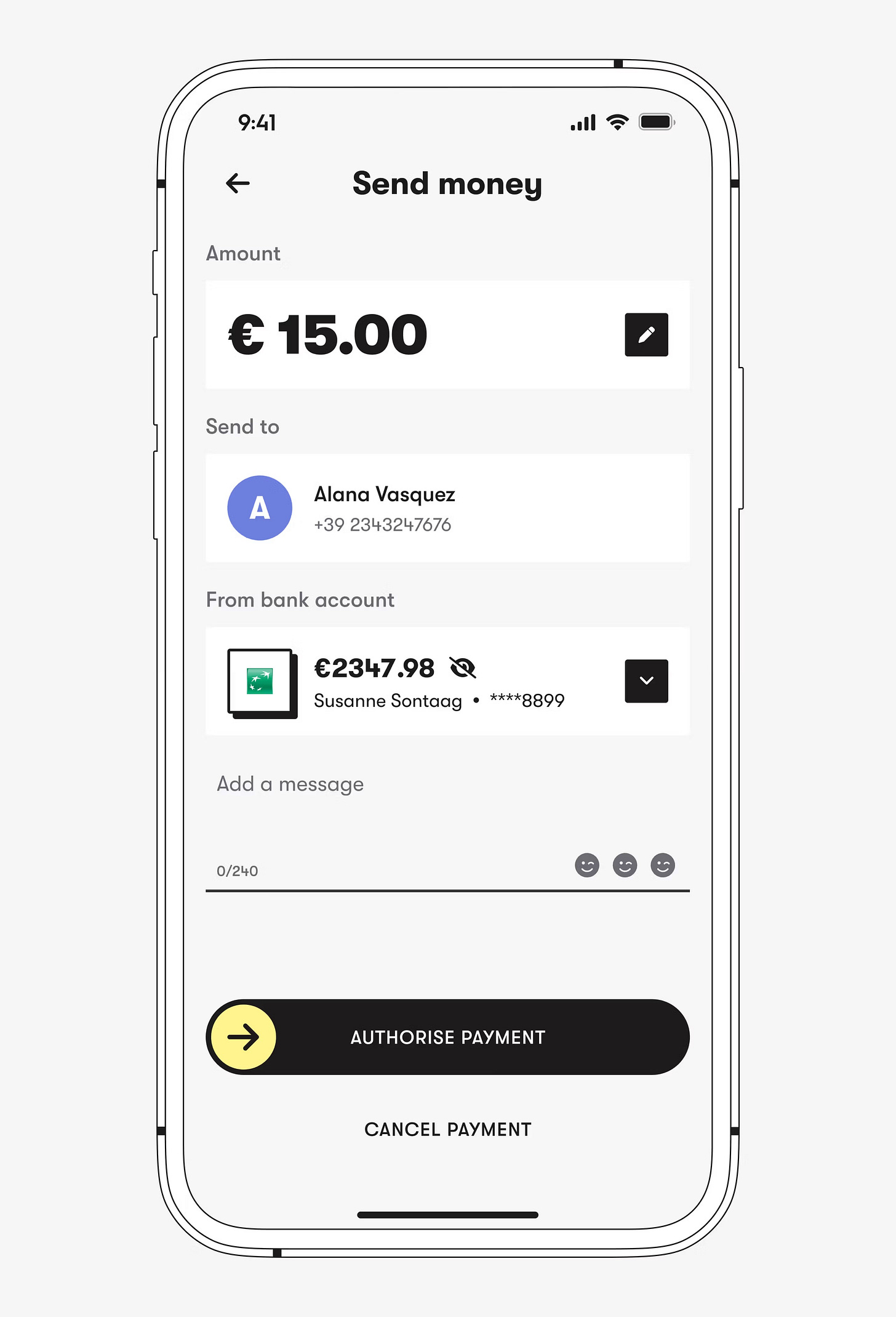

The Wero experience

First, customers need to enrol in Wero, provided they bank with one of the 30+ supported banks in Europe. This can be done directly through the supported banking app or by downloading the Wero app.

I like the fact that you don’t need to download the Wero app if you don’t want to (who needs another payment app, hey!).

(But you can connect multiple banks by using the Wero app).

Next, you can select the beneficiary (using your phone’s contact details) and confirm the payment (for peer-to-peer payments). The payment authentication happens in the bank app (through a push notification), similar to a 3DS transaction. Simple!

What about paying in stores or online?

Wero is still at an early stage - there’s not yet any clarity on when in-person or online payments will be fully rolled out (but it’s on the roadmap mentioned on their website). For now, it seems that a QR solution using the Wero app will be available soon.

There are also no details yet on their APIs or how they can be implemented with payment gateways. I’ll be keeping an eye out.

Will Wero transform the payment landscape in Europe?

Too early to say, but in my view, Wero has great potential. Wero’s peer-to-peer solution is a good start, but the real differentiator will be in-store and online payments.

Unfortunately, we will still have to wait, as Wero will need to work with all the European payment processors to make this happen.

An integration with Apple & Google Pay to fastrack growth?

OK, so there’s absolutely no mention of this from Wero - this is just my own view.

Combining an Account to Account (A2A) solution with the two leading device payment technologies could completely change the European payment game.

USD 150 Billion saved to merchants

With a transaction volume bigger than Mastercard alone ($6 trillion/year), Apple Pay is well placed to lead the change from card payments to A2A by integrating Wero (and other A2A networks like Aani in the future).

The good news is that Apple Pay only charges a tiny fraction of every payment - 0.15% per transaction. However, card schemes (plus payment processors) charge an average of 2.5% (and more) - that’s $150 billion in merchant fees (of Apple Pay’s yearly volume).

Integrating A2A networks would not change Apple Pay’s revenue, as they could still charge the same small fee, so there’d be no difference from a cost perspective. Technically, fewer intermediaries would simplify and speed up transactions, which is another advantage for Apple Pay.

So Wero, now you know what to do next 😉

Who’s behind wero

Wero has been a long time in the making. It was born out of the European Payments Initiative (EPI) founded in 2020.

EPI is a consortium of around 16 European banks aiming to transform all aspects of payments.

Such strong backing is a key enabler for Wero’s adoption and growth.

“We will act as the bridge between a multitude of parties in a complex landscape as we create a new four-corner payment ecosystem of banks, consumers, acquirers and merchants.”

Source: EPI website

Final thoughts

Wero is a step in the right direction and has great potential to shake up the payment landscape in Europe, as it can deliver significant value to both businesses and consumers.

Pay by bank offers leaner and better payment processing. With fewer intermediaries, faster transaction times, and above all, massive savings on interchange fees typically charged by card schemes and processors.

However, consumers need a strong incentive; otherwise, it will be challenging to convince them to adopt yet another payment method. There needs to be tangible value, and this is perhaps the hardest part for these account-to-account networks.

Card schemes have figured out how to incentivise banks, consumers, and sometimes merchants to use their products, with a plethora of marketing campaigns, discounts, and other funding used for promotion. This still needs a solution, as merchants alone won't be able to solve it.

In-person payments need to go beyond scanning a QR code. It's a cumbersome experience. It’s all well and good to have a state-of-the-art processing architecture, but what’s the point if the consumer experience is clunky? This is why an integration with Apple and Google Pay would make sense - to make the experience as simple as a tap.

Go Wero!

About Dom Monhardt, founder of one-fs.com

I am a French technologist and product leader living in Dubai, with 15+ years of experience in building cutting-edge and innovative digital experiences.

I am interested in the intersection of business, design, and technology and am deeply passionate about the fintech and digital banking world.