Tempo by Stripe: payments on a new chain

Plus Toss bets big on FacePay while SumUp delivers a slick experience for UK’s micro-merchants

I’m back! 😎🌴

After a month in the UK with family (and my first proper break from one-fs), I feel fully recharged for a new season ahead 💪

Here’s what you’ll find in this edition:

🇬🇧 SumUp’s rise across UK merchants

😗Toss FacePay scaling in South Korea

🛤️ Stripe’s new blockchain, Tempo

SumUp on the streets of Britain

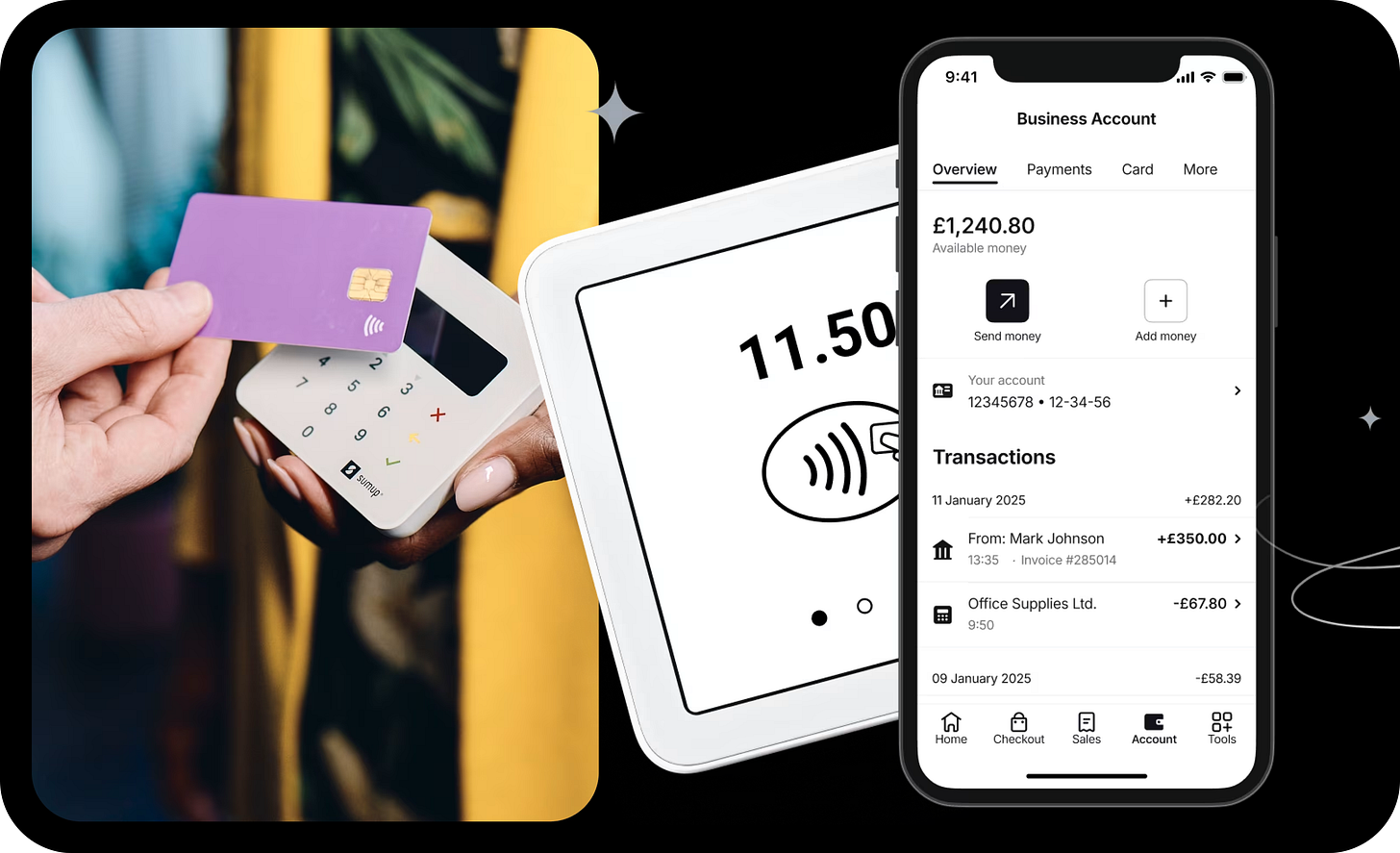

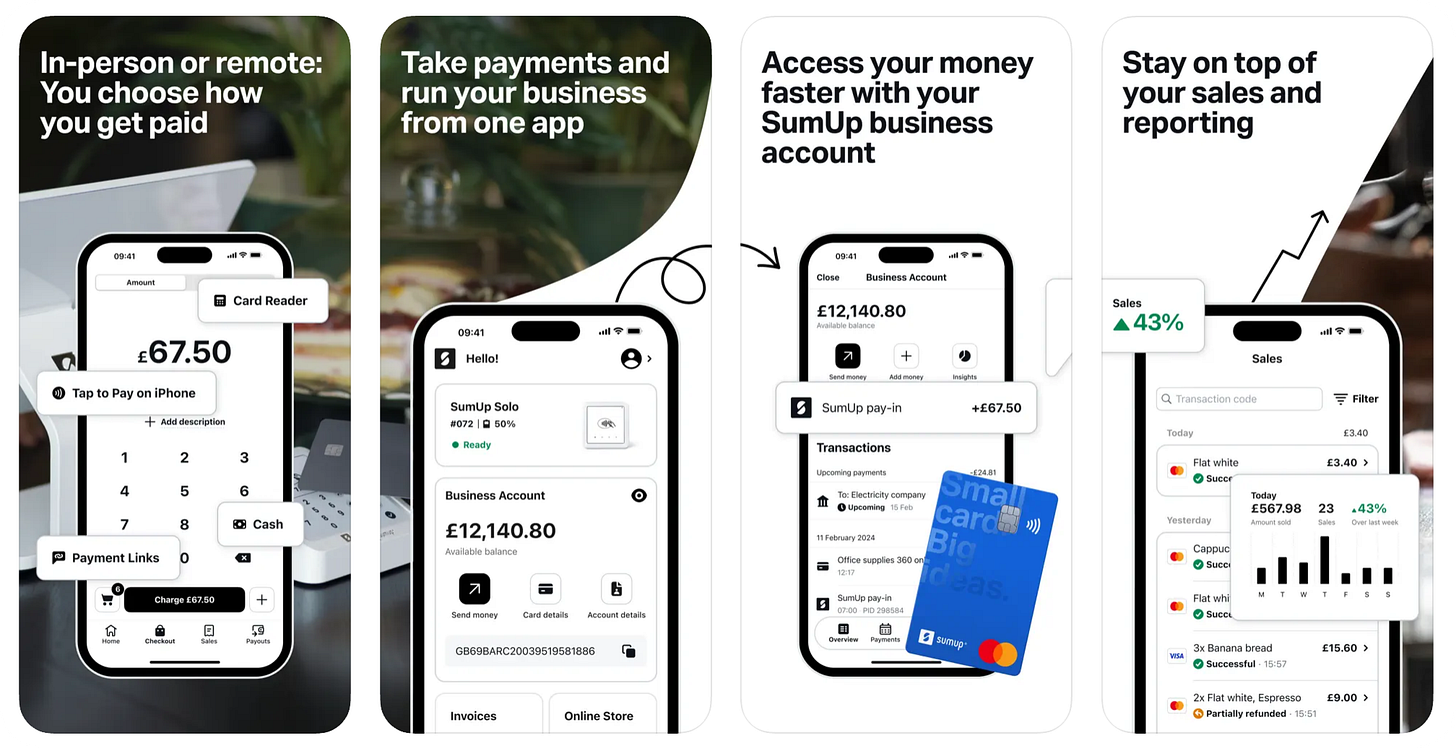

Even on holidays, I keep an eye out for payments in the wild. This time, I noticed a clear shift - more small businesses in the UK are accepting contactless payments. Taxis, food trucks, market stalls. And a lot of them using SumUp.

The SumUp Air reader was the most common - small enough to fit in a pocket, pairing with a phone via Bluetooth and the SumUp app. I also came across the SumUp Solo, a sleek device made entirely of an e-ink screen that runs independently with a SIM card.

The app itself feels well-designed: minimal, monochrome, and fast. No gimmicks. Just works.

SumUp says it already supports over 4 million UK businesses, making it a clear rival to Square.

Toss bets big on FacePay

On the other side of the world, South Korea’s Toss is ramping up its FacePay service after a successful pilot, aiming for 1 million stores by next year.

The system works by simply looking at the terminal - with a claimed 99.99% accuracy in under a second. Toss wants FacePay “to become the most widely used and frequently chosen payment method” across the country.

At the moment, FacePay has 400k registered users - a fraction of Toss’s massive 24 million active base - but it’s early days.

Toss is one of the most impressive East Asian fintechs I’ve seen: an ecosystem that blends banking, investing, insurance, and payments in one smooth package. It feels closer to what Revolut aspires to be than most Western players.

➡️ Want to read more about Toss? Check out my previous article (no paywall)

Is Toss 🇰🇷 the new Revolut? Discover this South Korean gem 💎

I vividly remember the genius launch of Kakao Bank, South Korea’s first mobile-only bank, born out of a social media messaging app.

👀 All eyes on Stripe’s Tempo, a blockchain built for payments

The big news this week is Stripe’s new venture with Paradigm: Tempo, a blockchain purpose-built for payments and stablecoins.

Why another blockchain? Because existing ones were never optimised for payments (shocking, I know!)

Ethereum is powerful but turns checkouts into a gas station stop - extra tokens for fees, and delays when NFT traders clog the network.

Solana is fast but still general-purpose, with payments sitting in the same queue as everything else.

Tempo focuses on one thing: moving stablecoins like real money. Instant, predictable, and with the rails merchants need - memos, batching, compliance hooks.

Built-in clarity

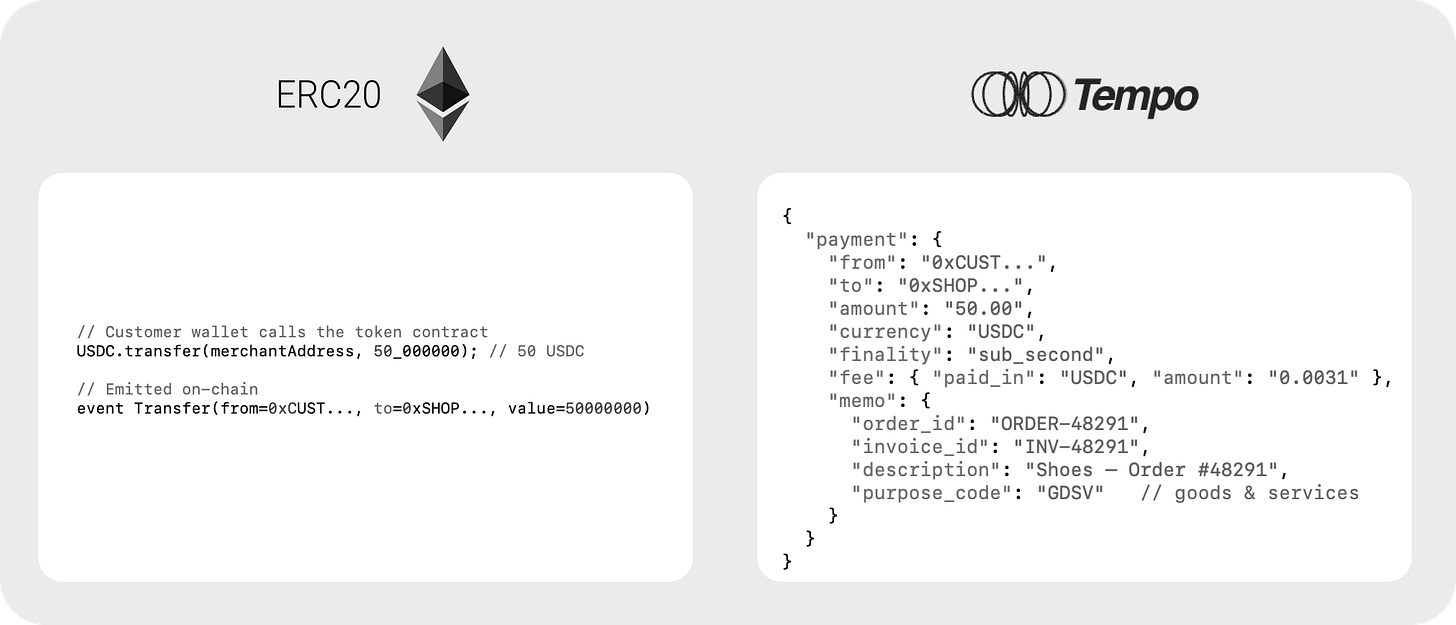

One standout feature is Tempo’s structured memo field. Unlike a standard ERC-20 transfer, where all you see is an address and an amount, Tempo lets you attach structured details directly to the payment. Think order IDs, invoice references, or even short notes that mirror the ISO 20022 format banks are adopting worldwide.

For merchants, this means automatic reconciliation. For customers, clear receipts in their wallets. A crypto transfer that finally looks like a proper payment message.

Revolut, Shopify and even Visa are involved

Tempo is being co-designed with some of the biggest names in payments and commerce - Revolut on the fintech side, Shopify on the merchant side, and Visa representing the card networks. Their expertise is influencing Tempo’s architecture around real-world payment flows, compliance needs, and merchant operations.

➡️ It gives Tempo a shot at solving the boring but critical parts of digital money that other blockchains have mostly ignored.

A permissionless blockchain

At its core, a blockchain is just a shared ledger that lots of computers (validators) keep in sync. Validators check each transaction, group them into blocks, and agree on the order so nobody can cheat.

In a permissionless network, anyone can run a validator, which keeps the system open and resistant to control. But blockchains can be centralised too - if only a handful of approved parties run the validators, then power sits with them.

Tempo says it wants to be permissionless in the long run, but at launch its validators will be run by partners like Stripe, Shopify and Visa, which means it will look more like a managed network until it opens up.

The open questions

Tempo has promise, but doubts remain:

Can it really scale to handle payment traffic at global volume?

Will wallets, liquidity, and merchant adoption follow quickly enough?

And do we truly need another chain, when stablecoins like USDC already run across Ethereum, Base, Solana, and Tron?

The test will come when real payments start flowing.

If this sparked ideas – or raised questions - I’d love to hear from you. Hit reply or DM me.

Until next time - Dom 👋

About Dom Monhardt, founder of one-fs.com

I am a French technologist and product leader living in Dubai, with 15+ years of experience in building cutting-edge and innovative digital experiences.

I am interested in the intersection of business, design, and technology and am deeply passionate about the fintech and digital banking world.