🏦💸 Why Traditional Banks Fail at Digital Transformation (and What Monzo Got Right)

£13 Billion Spent, No Progress Made: Lessons from Monzo, Tesla and the Power of Building In-House.

Building a standout digital banking experience isn’t just about investing in technology. It’s about leadership, organisational culture, technical autonomy, and a relentless focus on customer needs.

In this article, we’ll cover:

❌ Why traditional banks struggle despite massive digital transformation budgets.

➡️ How Monzo spent £92M to outperform £13B from legacy banks.

🔎 The Ipsos digital ratings and what they reveal about customer trust.

🚗 Why buying third-party solutions limits innovation - a lesson from Tesla.

⚙️ How Monzo’s in-house approach redefines banking’s future.

👩💻 The critical role of a Chief Product Officer (CPO) in transforming banks.

🕺 What banks can learn from Tesla’s ‘Dance Mode’ to deliver memorable digital experiences.

Deep down, people often assume that banks spend excessively and misuse their profits. This sentiment was amplified during the 2008 financial crisis, when ‘golden parachutes’ became infamous despite banks underperforming.

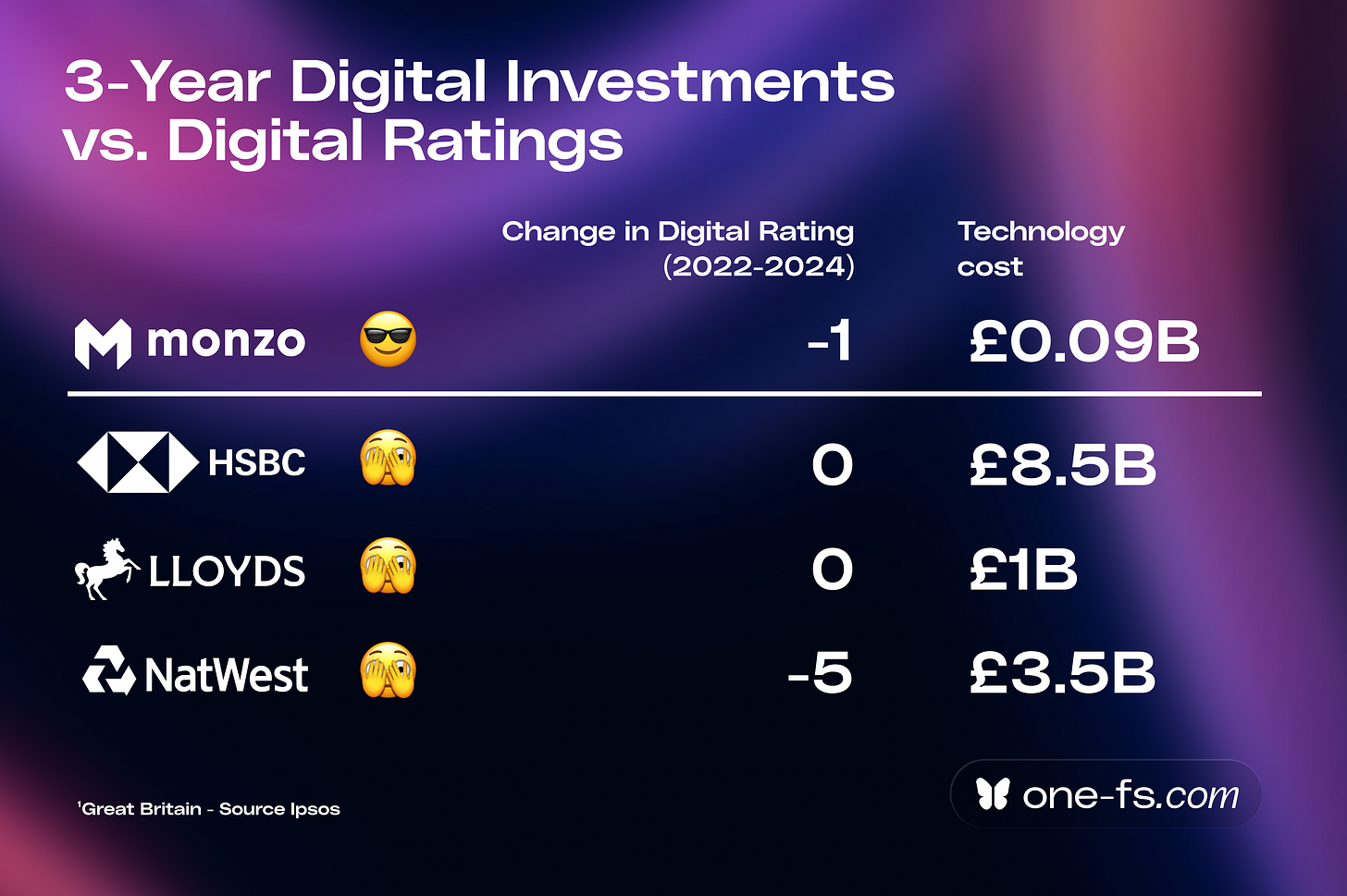

So it’s with no surprise that my last linkedin post went viral when I revealed that three of the largest UK banks spent over £13 billion on their digital transformation efforts - yet saw no improvement in their digital ratings.

In stark contrast, Monzo has topped the digital rating leaderboard for the past three years, while spending just £92 million - a mere fraction of the cost.

HSBC: 69% → 69% (no change, £8.5B spent)

Lloyds: 77% → 77% (no change, £1B spent)

NatWest: 74% → 69% (-5, £3.5B spent)

monzo: 85% → 84% (-1, £92M spent)

Let’s break it all down to understand exactly what happened.

What are digital ratings?

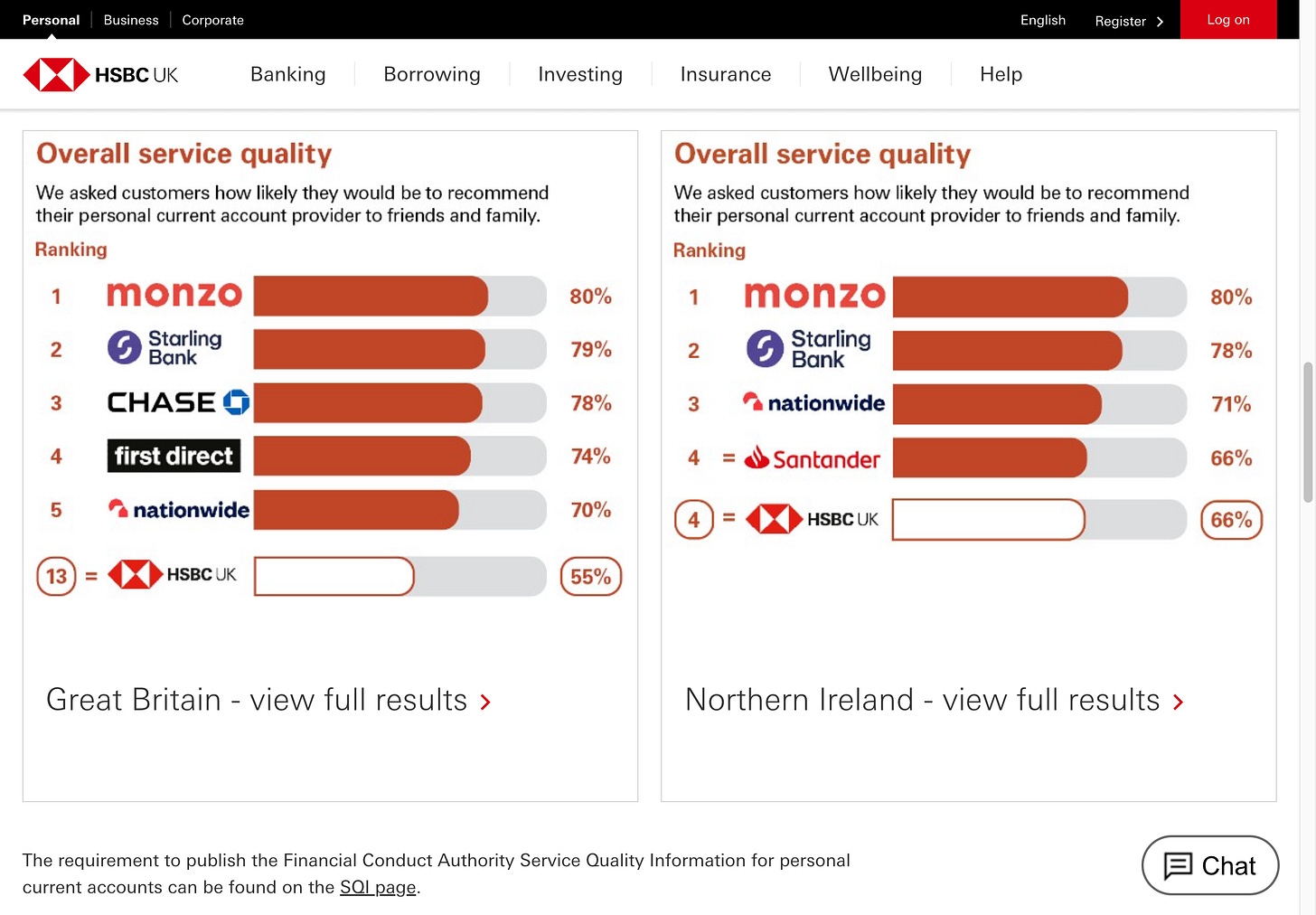

I used the term “digital ratings” here to refer to the personal banking service quality rankings for online and mobile banking services in Great Britain.

This data comes from Ipsos, a leading market research firm mandated by the UK’s Competition and Markets Authority (CMA) as part of a regulatory requirement. Ipsos conducts surveys with 1,000 customers of the largest banks, asking if they would recommend their provider to friends and family. The surveys cover the following areas:

Overall service quality

Online and mobile banking service (the score I’ve used)

Overdraft services

Services in branches

UK banks are required to display these rankings prominently on their website homepages, whether they like it or not. This regulation aims to push banks to improve and prioritise their customer experience.

(I personally think this is a fantastic requirement and would love to see it implemented in more markets.)

Not exactly a great marketing story for a bank to showcase on their website: “Hey, people don’t really like our products and services - you’re better off with these other banks.” Ouch.

The Ipsos surveys are somewhat similar to an NPS (Net Promoter Score) survey, except that detractors (those rating 6 or below on the 1-10 scale) aren’t subtracted from the final score. Instead, the rankings are based solely on the percentage of respondents who are “extremely likely” or “very likely” to recommend the bank.

Of course, survey methodologies can always be debated (see the full methodology here), but Ipsos’ consistency across all banks offers a good and fair basis for comparison. Since these surveys have been running for seven years, they also allow for easy year-over-year comparisons, with previous years’ data readily available on the Ipsos website.

Are these ratings relevant?

Absolutely. While not perfect, the consistency of the methodology across all banks makes it a reliable comparison tool. The Ipsos ratings are far more credible than app store ratings, which can often be influenced by various strategies to skew the results.

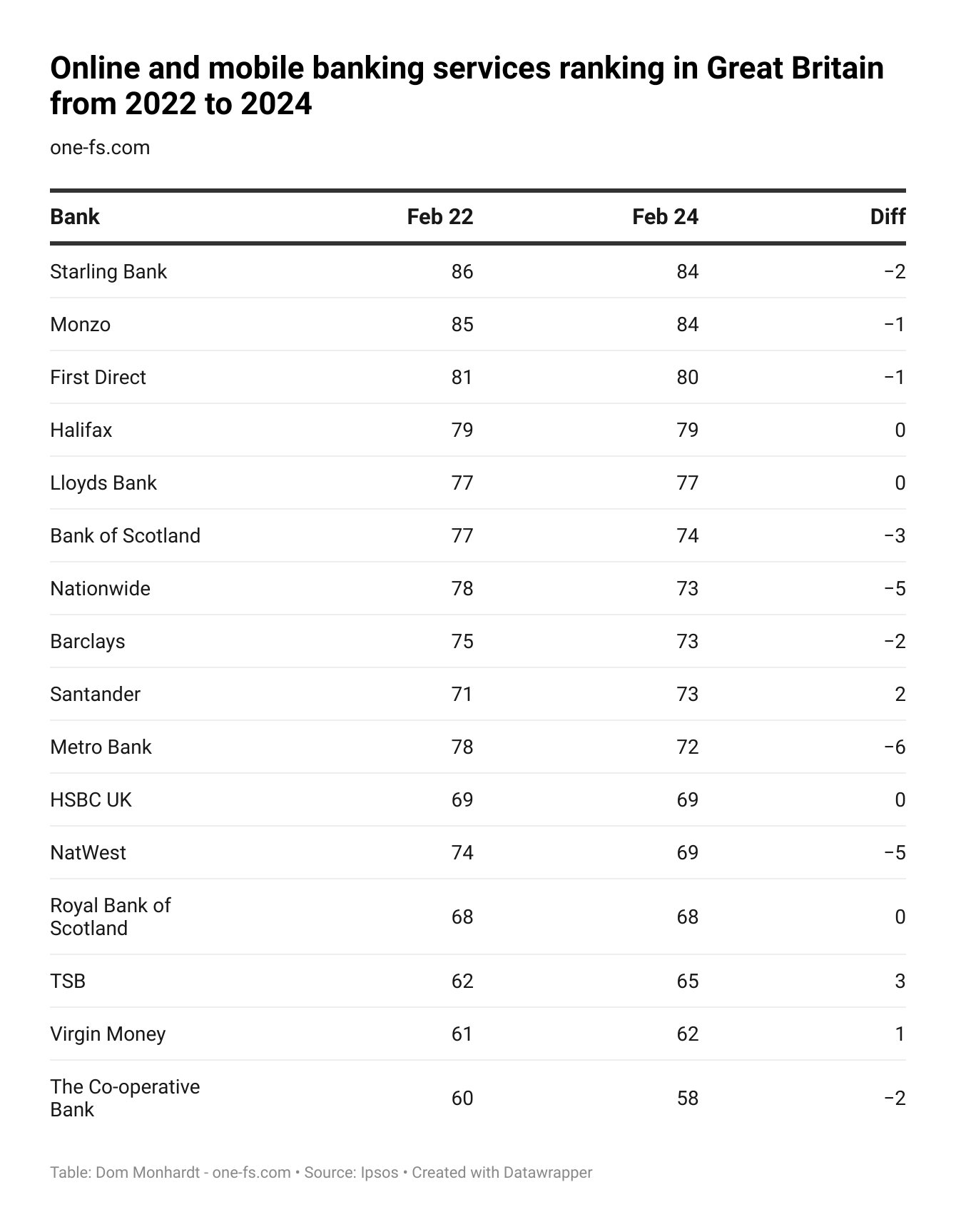

Online & Mobile Banking services ranking for all banks in Great Britain from 2022 - 2024

Key insights:

Leaders in the Ranking:

Starling Bank and Monzo are the top performers with scores of 84 each in February 2024. However, both experienced slight declines compared to February 2022 (Starling Bank: -2, Monzo: -1).

First Direct follows closely at 80 in February 2024, with a minor decline of -1.

Most Stable Performers:

Halifax and HSBC UK maintained their scores from February 2022 to February 2024, showing no change (79 and 69, respectively).

Royal Bank of Scotland also remained steady at 68.

Biggest Improvement:

TSB saw the most significant improvement, increasing its score by 3 points (from 62 to 65).

Santander also improved by 2 points, reaching 73 in February 2024.

Largest Declines:

Metro Bank experienced the largest drop in score, decreasing by 6 points (from 78 to 72).

Nationwide & NatWest also saw a notable decline of 5 points (from 78 to 73).

Emerging Trends:

Digital-first banks like Starling Bank and Monzo continue to dominate, though their growth seems to have plateaued slightly.

Traditional banks like Santander and TSB are showing signs of improvement in their online and mobile banking services, but still a long way to the top of the leaderboard.

Bottom Performers:

The Co-operative Bank has the lowest score of 58 in February 2024, declining by 2 points since February 2022.

Virgin Money remains near the bottom despite a slight improvement, increasing by 1 point to 62.

Digital Transformation Investments vs Customer Service Rankings

In the first chart of this article, I plotted the Ipsos customer service rankings of several banks against their technology spend and digital transformation investments.

I was curious to explore:

Are the digital transformation investments from traditional banks yielding fruitful results?

How does the cost of technology compare between traditional and digital banks?

I vividly recall the “digitalisation” announcements from some of the largest banks, such as Lloyds Bank and NatWest, following the COVID-19 pandemic. At that time, it became clear that offering robust digital services was no longer a luxury but a hygiene factor for banks.

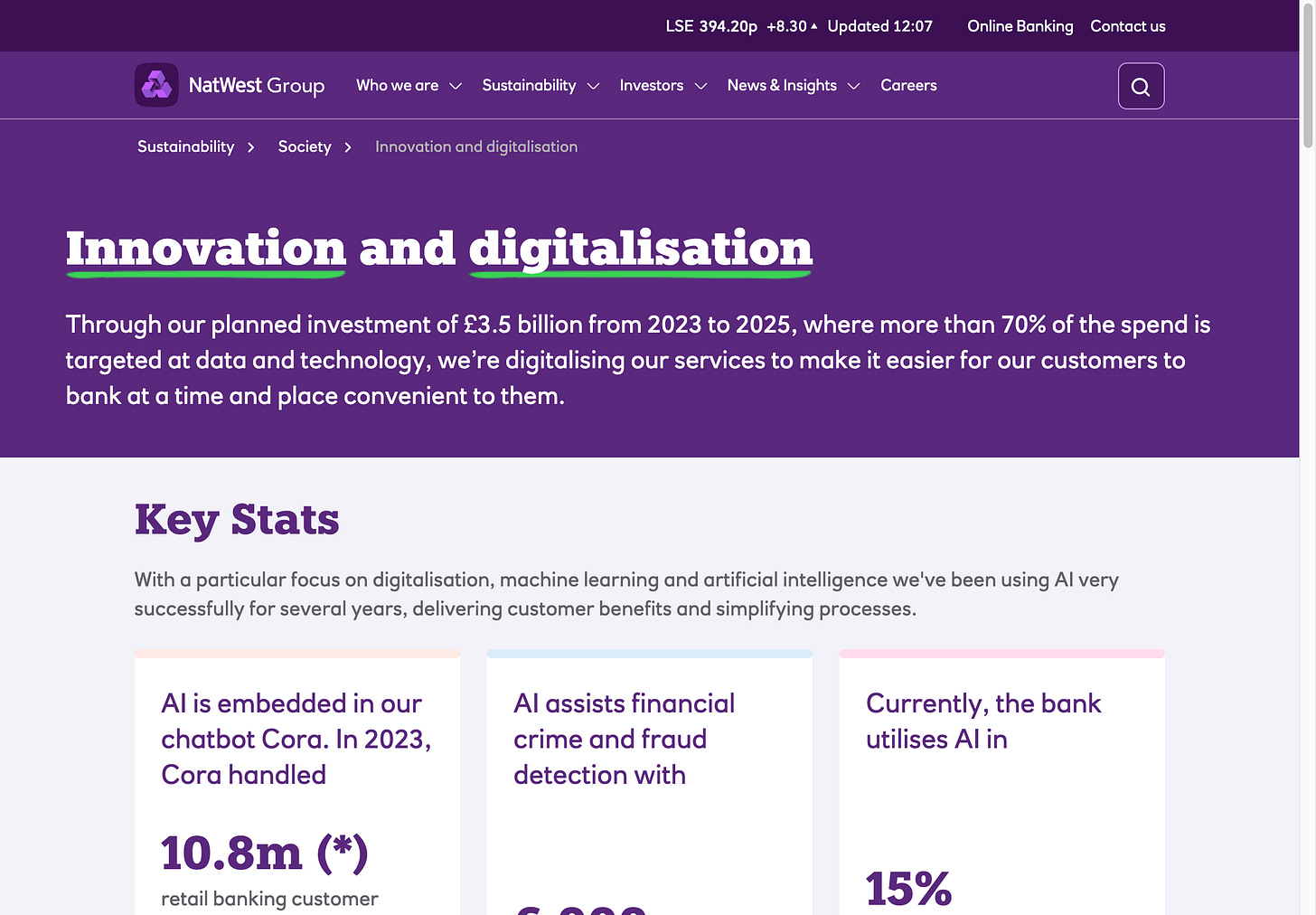

For many banks, these digitalisation investments were marketed as customer-centric initiatives aimed at improving convenience and service quality. For example, NatWest has a publicly accessible page highlighting their £3.5 billion digitalisation investment for the period 2023–2025, framed as a move to enhance the customer experience.

So naturally, I wanted to understand - would such colossal investments of billions of pounds change the game?

Some caveats:

Scope of analysis: I reviewed four banks - three traditional and one digital, using figures available online, prioritising their websites and annual reports.

Broad coverage of traditional banks’ investments: Digital transformation investments from traditional banks often encompass multiple verticals, such as business banking, commercial banking, and institutional services, not just personal banking.

Limitations of “technology cost”: The quoted investment figures represent additional spending on top of existing business-as-usual (BAU) costs, which are not disclosed in detail.

Different customer bases: HSBC operates in over 30 countries with 39 million customers, whereas Monzo serves only the UK with around 10 million customers. However, scaling costs in digital banking are not linear, and advances in AI have the potential to significantly reduce high-cost areas such as customer support.

Key insights

No significant ranking improvements for traditional banks

None of the three traditional banks that invested heavily in digitalisation over the past 2-3 years saw an increase in their customer service rankings:HSBC and Lloyds remained flat.

NatWest dropped by 5%.

Monzo, though still leading, saw a slight decrease of 1%.

Massive spending with limited impact on rankings

Combined, HSBC, NatWest, and Lloyds invested £13 billion in digitalisation.

Monzo’s BAU technology cost over the same period was just £92 million.

Individual performance breakdown

NatWest: Invested £3.5 billion in digitalisation but experienced the biggest drop in rankings (-5%).

HSBC: Invested the most (£8.5 billion) but saw no change in its ranking (69%).

Monzo: Maintained the highest rating in Great Britain, tied with Starling Bank (both at 84%).

Insights from my journey in digital banking transformation

After sharing my recent post on LinkedIn, several people reached out to ask why traditional banks often struggle to see the fruits of their digitalisation and innovation efforts.

I’ve been fortunate enough to play a role in the digital transformation of the UAE’s oldest bank, leading the first major banking transformation in the entire Middle East region eight years ago.

If you’re interested, you can find some of my learnings from that experience in these earlier posts: How to Become the #1 Bank in the App Store Part 1 and Part 2

This experience was eye-opening for me as it was my first exposure to working within a traditional bank. While I was surrounded by incredibly talented individuals and inspiring leaders, I couldn’t help but feel that our entire team was held back by insurmountable cultural constraints - deeply ingrained in the way traditional banks operate.

Later, as I connected with peers from similar organisations, both regionally and globally, I noticed certain patterns kept repeating:

Technology & vendors defined way ahead of the customer experience and architecture.

In traditional banks, technology and vendors are often defined well in advance of considering the customer experience or overall architecture. This approach reflects a deep-rooted reliance on large enterprise vendors, known for selling trust and reliability while promising the world. These vendors excel at ticking all the right boxes in an RFP process, creating the illusion of a perfect fit.

But as Elon Musk says, “Everything looks great on a PowerPoint” - the reality on the ground is often very different.

Details Matter in Digital

In digital banking, the details matter. While a predefined stack may offer some advantages in consistency and reliability, it often becomes a significant roadblock to innovation in architecture and customer experience design.

For example: want to simplify customer logins by replacing outdated “username” fields with a modern identifier like an email or phone number? “No can’t do”- courtesy of that Oracle database you’re required to use.

Buy vs Build

Building on the previous point, traditional banks overwhelmingly choose to buy third-party solutions rather than build their own. Once purchased, engineers, architects, and designers are tasked with working backwards to adapt to what was bought.

This approach often stifles innovation, frustrates talented individuals, and introduces numerous challenges, such as:

Interoperability issues: Different systems and standards lead to inefficiencies.

Knowledge gaps: Limited understanding of third-party tools slows decision-making.

Bottlenecks: Dependencies on vendors for every adjustment (“We need to call the vendor in Iceland to see if this is possible”).

How Tesla digitalised cars - an inspiration for banks

This reliance on third-party technology mirrors the traditional car manufacturing model. Automakers use hundreds of third-party parts, each with different standards, protocols, and designs, leaving little room for experimentation or disruptive innovation.

In contrast, Tesla builds and designs most of its parts in-house. This approach enables them to:

Innovate rapidly: Tesla can optimise how components interact, resulting in breakthroughs like over-the-air updates. Traditional automakers could only dream of enabling features like self-driving or remote issue fixes without recalls or garage visits.

Create viral features: Tesla’s in-house control has enabled playful, memorable features like “Dance Mode” or “Fart Mode.” While these features can sound useless, they often leave a lasting impression, creating word-of-mouth buzz and emotional connections. People may buy a Tesla because they’ve heard about these fun quirks, not just because it’s a sustainable electric car.

So, what’s the ‘Dance Mode’ of your banking experience?

Monzo: Banking’s Tesla

Monzo has embraced a similar philosophy to Tesla by building its own core banking and back-end platform from scratch. This approach has enabled Monzo to:

Innovate faster: With full control over their systems, Monzo can experiment and release features at a pace traditional banks can’t match.

Simplify operations: In-house development eliminates dependencies on external vendors, making it easier to scale and adapt.

Monzo’s journey began with just three engineers building their core banking platform. You can read more about how they achieved this here.

The Drawbacks of Buying Third-Party Solutions

Traditional banks’ reliance on third-party vendors doesn’t just hinder innovation - it wastes time and resources in endless processes:

Prolonged RFPs and negotiations: Months of back-and-forth to finalise business cases and contracts.

Scope reduction: To lower costs, required features often get stripped away, leaving a narrower and less ambitious scope.

Non-technical negotiations: Cost-cutting decisions are often led by those with little understanding of the technology, product, or design, resulting in short-sighted compromises.

Traditional Banks Are Not Organised Like Tech Companies

When traditional banks embark on digital transformation, they often aim to behave like a tech startup or create a startup-like function within the bank. But the organisational design of a bank is fundamentally different from that of a tech company.

Take the role of product managers in banks, for example. Typically, “product managers” in traditional banks are financial product managers, experienced in banking but with little to no experience in technology. These individuals often call the shots on digitalisation, applying outdated methods and concepts.

The Role of Traditional Bankers in Digital Transformation

To be clear, these traditional bankers bring valuable domain expertise and should absolutely be part of the product team. Their insights are critical for advising on banking-specific nuances. However, digital banks need to operate like tech companies, under the leadership of a Chief Product Officer (CPO).

What a CPO Brings to the Table

A CPO is essential to driving a digital bank’s transformation. This role requires someone who:

Deeply understands technology: they know how to code (as Elon Musk says, “You cannot be a cavalry captain if you don’t know how to ride a horse”).

Understands design principles: The ability to shape user-centric, intuitive interfaces and experiences is key.

Has a strong grasp of banking: While technical expertise is critical, a foundational understanding of banking is equally important.

The CPO’s responsibilities include:

Defining the product vision and strategy for the bank.

Acting as a product evangelist and the voice of the product internally and externally.

Advocating for customer needs and ensuring a strong product-market fit.

Setting priorities, allocating resources, and aligning teams.

Owning the product roadmap and being accountable for the success of the product portfolio.

For a deeper dive into how product functions operate in tech companies, I highly recommend the book “Inspired” by Mary Cagan.

What Banks Get Wrong

Instead of hiring CPOs, banks tend to appoint Chief Digital Officers (CDOs) or create “digital factories,” labs, and similar structures. While these efforts are well-meaning, they often fail because:

Shadow organisations: These digital units operate with limited authority, and their “product owners” frequently lack control over their roadmaps.

Structural misalignment: These roles are often placed within the technology group or in an ambiguous position between business and technology, leaving them without clear ownership, influence and vision.

Design by committee: Banks love the reassurance of committee-led decision-making. However, this approach is ill-suited to tech products, where bold, cohesive leadership is essential.

What Needs to Change

For digital transformation to succeed, banks must rethink their organisational design and leadership roles. Instead of patchwork solutions like digital labs or committees, they need to emulate tech companies by placing experienced product leaders in charge - leaders who understand technology, design, and banking.

By doing so, they can create products that are not only innovative but also genuinely meet customer needs and set new standards for the industry.

I’m running out of space for this post, so I’ll wrap up here with a post I recently came across from David Jimenez Maireles, a global leader in Digital Banking. Here’s what he has to say about why driving innovation in traditional banks is so challenging:

About Dom Monhardt, founder of one-fs.com

I am a French technologist and product leader living in Dubai, with 15+ years of experience in building cutting-edge and innovative digital experiences.

I am interested in the intersection of business, design, and technology and am deeply passionate about the fintech and digital banking world.