Money 2.0: How Programmable Money is Transforming Finance

From Static to Dynamic - How Programmable Money and Blockchain Are Reshaping Banking, Payments, and Economic Innovation.

Most of today’s fintech still operates on decades-old rails. We’ve patched up Money 1.0 with tech band-aids, but it’s time to rethink money for the digital age.

In this article, we’ll cover:

❌ Why today’s money movement is stuck in the analogue era.

🍿 The difference between Money 1.0 and Money 2.0, explained with a simple movie analogy.

👩💻 How programmable money is transforming the movement of money

📱 Why Nubank’s USDC strategy is a game-changer for Latin America.

👾 How stable digital currencies like USDC are merging traditional finance with blockchain.

👋 HSBC closed down Zing - what went wrong?

Money 1.0 vs Money 2.0

Most of today’s fintech and digital banking still relies heavily on card payments or traditional rails to move money. We’ve strapped technology onto Money 1.0 as a band-aid to make it more efficient, creating smart workarounds and patches, but fundamentally, today’s money movement is still based on systems and protocols that are over 40 years old.

Enter “new” technologies like blockchain, though some components, like Merkle Tree cryptography, date back to 1979, the core concept emerged in 2008 with Satoshi Nakamoto’s Bitcoin whitepaper. While these innovations have been embraced by web3 companies, they’ve largely struggled to find their go-to-market strategies and achieve widespread adoption.

Part of the challenge is the confusion and misunderstanding that surrounds these technologies, much of it fueled by the technical complexity and jargon web3 companies have introduced.

Forget “web3” or even “blockchain” for a moment, I know those terms alone can be a turn-off for many. Here’s my take on what I call Money 2.0:

Think of money as a movie.

In the analogue era, movies were static.

A reel of film could only be played in one way - no subtitles, no alternate languages, and no interactivity like Netflix’s Bandersnatch, where the plot evolves based on the viewer’s decisions. It was a one-dimensional experience, constrained by the limitations of the physical medium.

Then came digital movies.

Suddenly, a single file could include subtitles in multiple languages, audio commentary tracks, interactive menus, and metadata like scene descriptions. The movie became dynamic and versatile, catering to different preferences and unlocking new ways to engage with the content.

💵 Now, let’s look at money.

Traditional (analogue) money is static - it can be exchanged or saved, but its functionality is limited to basic use cases. Every additional feature, like scheduling payments or enforcing conditions, requires intermediaries like banks, payment processors, or escrow services.

Analogue money is utterly inefficient, isn’t transparent, and relies heavily on intermediaries, which adds delays, costs, and layers of complexity to even the simplest transactions.

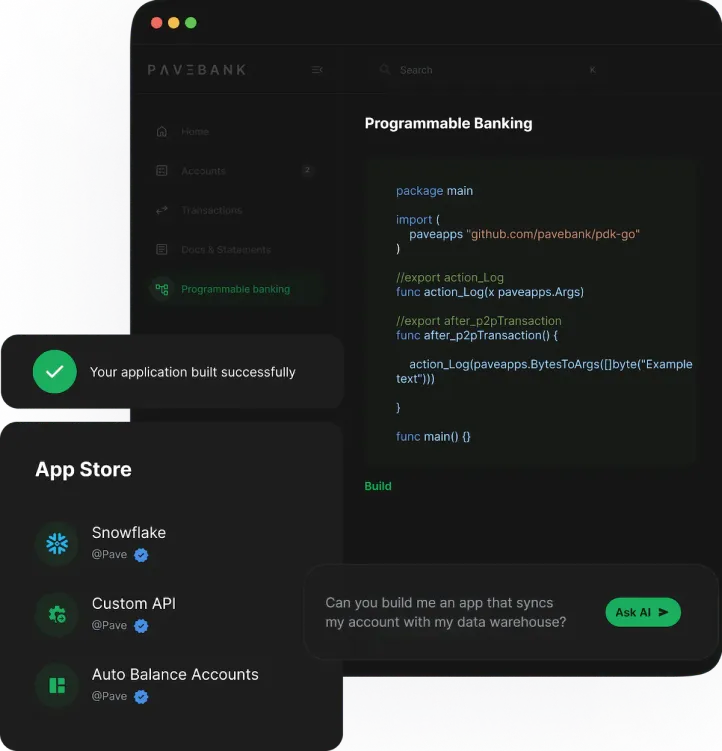

Programmable money through smart contracts is like the digital movie revolution. By adding layers of programmability, we can embed rules, conditions, and logic directly into financial transactions. A single unit of programmable money (like a token) can now carry instructions to:

Release funds only when certain conditions are met (like an escrow).

Reward someone instantly for completing a task (like staking or earning interest).

Automatically split revenue between multiple parties (like royalties).

Verify and enforce compliance (like AML/KYC rules).

🏡 Take real estate transactions as an example:

Traditionally, buying a property involves banks, escrow agents, and a mountain of paperwork. But with a smart contract deployed on a blockchain, the process becomes seamless and automated. The buyer deposits funds into the contract, and the contract holds the money in escrow until conditions are met - such as verifying the ownership transfer via a government registry. Once verified, the smart contract releases the funds to the seller instantly. If the conditions aren’t met, the buyer gets a full refund, all without needing a bank to mediate.

Governments like the UAE already utilise blockchain technology to record all real estate contracts, including lease registrations and title deeds, seamlessly linking them with other utilities like electricity, water, and telecommunications. Combined with digital services like UAE Pass, which provides access to identity and residency details, the UAE is positioning itself as a market ripe for fintech innovation.

📕 Reading list: Read Write Own by Chris Dixon

If you want to learn more about blockchain technology, I highly recommend this book by Chris Dixon (partner at a16z).

The book delves into how blockchain technology can radically transform the future of the internet, focusing on key principles like ownership, transparency, interoperability, and decentralisation.

USDC on the rise 🚀

We’re now seeing stable digital currencies like USDC (issued by Circle) taking significant leaps forward.

Circle’s vision is to make USDC the backbone of the internet’s financial layer, seamlessly merging traditional finance with blockchain to foster economic prosperity.

Here are some key numbers about USDC:

Monthly transaction volume: $1 trillion (November 2024)

All-time volume: $18 trillion

Accessibility: Available to over 500 million end-user wallet products

Wallet adoption: 3.9 million wallets hold at least 10 USDC

Growth: 78% year-over-year growth in the last year

This rapid adoption underscores the growing potential of stablecoins in shaping the future of finance.

Nubank’s USDC strategy

Nubank, the world’s largest digital banking platform outside Asia, serves over 105 million customers across Brazil, Mexico, and Colombia.

With Circle’s launch in Brazil last year, Nubank seized the opportunity to partner with them, offering users near-instant, low-cost, 24/7 access to USDC.

Many Latin American countries face significant currency devaluation, which impacts purchasing power. By enabling customers to transact in USDC, Nubank can offer a stable alternative to local currencies, especially in markets like Argentina or Venezuela, where inflation is a critical issue.

USDC allows for low-cost, near-instant cross-border payments, which can be a massive benefit in a region where remittances play a significant role in the economy. If Nubank integrates seamless remittance options via USDC, they can tap into a new, loyal user base.

Key Features of Nubank’s USDC Offering:

Access to Dollars: Users can hold USDC as a store of value, protecting against local currency volatility.

Flexible Transactions: Users can transfer USDC to other wallets and increasingly use it for day-to-day financial activities.

Nubank offers a 4% annual return on USDC balances.

Impact of the Strategy:

Last year, Nubank reported a 10x increase in the amount of USDC held by its customers, with approximately 30% of its user base now holding some USDC.

By leveraging USDC, Nubank is empowering its users with greater financial flexibility and access to global currencies, positioning itself as a leader in fintech innovation in Latin America.

“As Nubank continues to expand its reach across Latin America and beyond, USDC will be a cornerstone of our strategy to empower our customers with innovative financial solutions. Its stability, global reach, and commitment to regulatory compliance make it the ideal partner for us as we build a more inclusive and accessible financial future.”

Thomaz Fortes - GM of Crypto at nubank

🇦🇪 Local News

Pluto - The Ramp of the Middle-East - has raised $4.1 million 🎉

Co-Founder and CEO Mo Aziz has been a one-fs reader from day 1 so this is particularly exciting to share! 🚀 Pluto is transforming spend management for businesses in the Middle East, offering modern solutions that make managing corporate expenses effortless. Huge congrats to Mo and the team for this milestone - can’t wait to see what’s next for Pluto!

MoneyHash - Middle-East’s first payment orchestration platform - secures $5.2 million in Pre-A funding round 🎉

Well done Nader Abdelrazik and team!

💼 As seen on Linkedin

HSBC to close down Wise’s “disruptor” ZING

This week, I shared the news that HSBC has shut down its digital banking venture, Zing, just one year after launch. Zing was actually the subject of the very first one-fs article.

In my review, I noted that Zing was technically well-executed: it had great UX, a modern UI, and a smooth, responsive app experience.

But the strategy was unclear:

Confusion for HSBC customers: Existing customers already had access to HSBC global accounts with affordable international remittances.

Weak pull for new customers: Zing didn’t offer enough differentiation to attract users from competitors like Wise, Revolut, or Monzo.

So, who was Zing for? Why was it launched as a separate brand and product? And why wasn’t the product revolutionary, despite a $150 million investment?

Just two weeks ago, I shared Beyond UX: Building Fintech That Wows where I used Zing as an example (unaware of its impending closure) to illustrate why good UX alone isn’t enough to drive desirability.

HSBC missed the opportunity to leverage their last-mover advantage by venturing into new paradigms, as discussed in this article, and failed to deliver magic ✨.

About Dom Monhardt, founder of one-fs.com

I am a French technologist and product leader living in Dubai, with 15+ years of experience in building cutting-edge and innovative digital experiences.

I am interested in the intersection of business, design, and technology and am deeply passionate about the fintech and digital banking world.