🤖✨ Say Goodbye to Fintech & Banking Apps: Why AI Agents Are the Next Big Thing

Discover Why Fintech & Banking Apps Will Be Obsolete in 10 Years

Happy New Year!

It’s one-fs’ first birthday 🎂🕺

Wow, I can’t believe it - it’s been a real privilege to write for you, week after week!

One year also means there are now over 52 articles to explore if you haven’t been here since the start. Last week, I shared some of my favourite articles here.

And here is the most viewed article of the year (my personal favourite too) - an exclusive interview with Abhishek Tripathi from Careem.

Catch up here if you missed it:

As seen on Linkedin

I recently reviewed a few digital banking apps, analysing how well their home screens cater to top user needs and their performance.

I shared the results on LinkedIn - it reached over 32,000 people, and judging by the engagement, it’s clear that many are frustrated by organisations prioritising business needs over user needs.

Check it out and share your thoughts in the comments!

🤖✨ Say Goodbye to Fintech & Banking Apps: Why AI Agents Are the Next Big Thing

I’m sure you haven’t escaped the wave of social posts about the new “agentic era” - the latest buzzword in the AI saga.

While many are rushing to explore obvious business use cases, there’s surprisingly little focus (so far) on the consumer side, especially in fintech and digital banking.

For those looking for the TL;DR on AI agents: it’s about combining chat with actions. Instead of just receiving a simple answer to your prompt, an “agent” (essentially a bot) offers superior reasoning, creates a plan of action, and executes the necessary steps it has access to.

This concept isn’t entirely new - we’ve seen it before with tools like Auto-GPT (released in 2023) - but it’s been popularised recently by innovations like Claude’s “Computer Use,” a bot that can control your computer to perform tasks on your behalf.

Another standout example is Replit Agent, an AI coding tool that develops applications from a single prompt. For instance, if you wanted to create a credit card finder app, it could generate a basic version within minutes by creating a plan, detailing tasks, and executing them step by step until the app is complete.

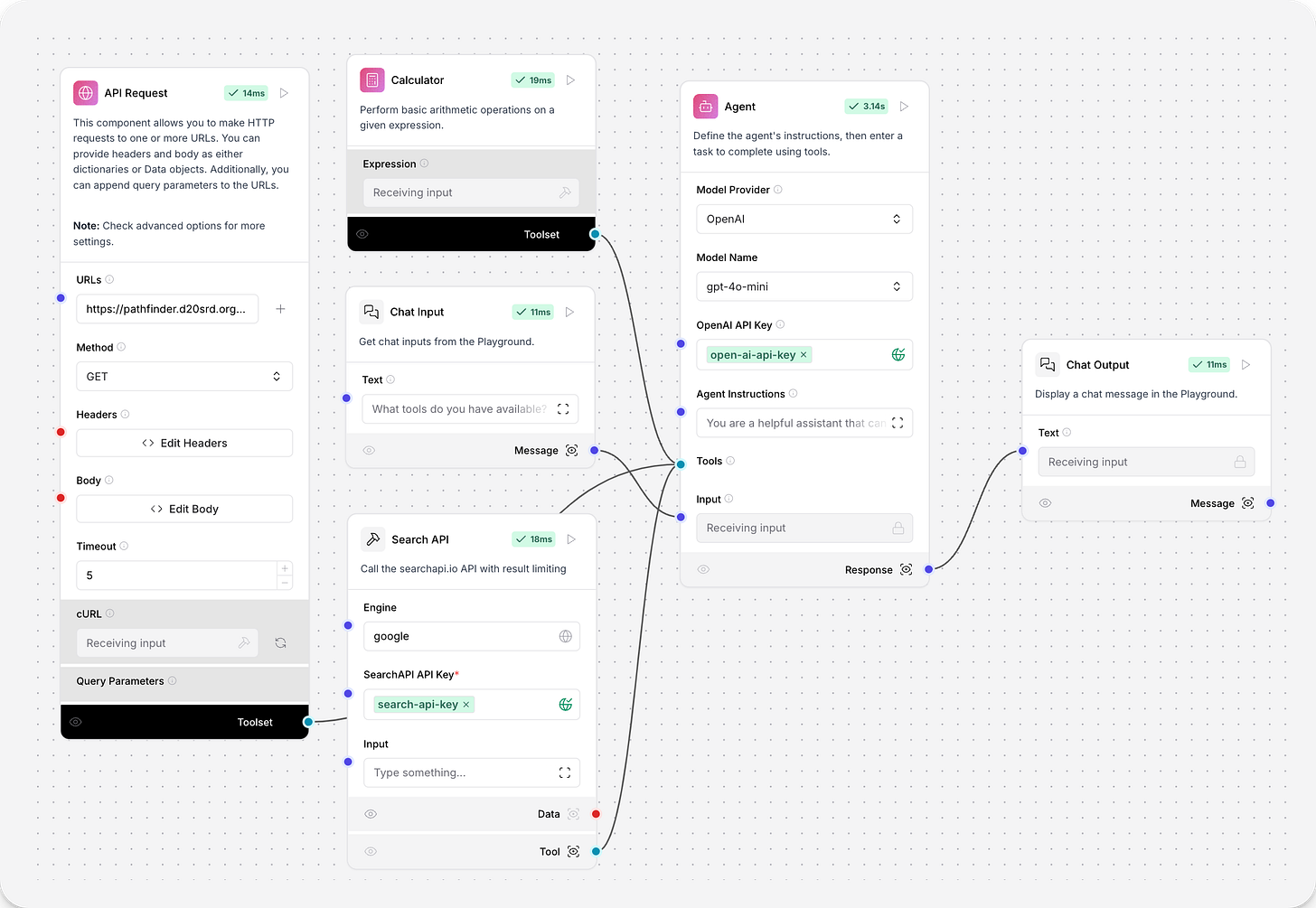

Tools like Langchain take this further by enabling the creation of custom workflows. Think of it as a more advanced version of “if this, then that” logic, where you can integrate your choice of AI models, APIs, and content, while adding capabilities like web searches, performing calculations, saving data to a database, and more.

Ramp’s fintech agent - What not to do

Ramp was one of the first fintech companies to create an AI agent on Langchain, dubbed “Tour Guide,” an educational UX guide for their customers.

Ramp’s Tour Guide is an AI agent designed to help customers navigate their platform. Instead of a traditional tutorial or walkthrough, the agent responds to a user’s how-to request by directly navigating them to where they need to go and demonstrating the steps right before their eyes.

Here’s a quick demo:

My take on it:

Technically, it’s well-executed. Practically, it misses the mark. Product walkthroughs are essentially a band-aid for bad UX.

Creating an AI agent to enhance this band-aid doesn’t solve the underlying problem - it won’t improve your user experience.

Take the extreme example of a light switch or a door handle. They’re designed to be intuitive. If they require a handbook or careful thought to operate, that’s a design failure.

Ramp, however, argues that their goal is to emphasise collaboration with customers, building trust as the agent demonstrates each step while providing contextual information.

❌ This example highlights how businesses fundamentally misunderstand the purpose and potential of AI.

Let’s get to the core of it: users have a problem to solve - a job to be done - and businesses offer a solution for it.

➡️ The fastest, easiest, most cost-effective, and most accurate way to solve that problem will always win.

Fintech tasks are rarely entertaining, and requiring customers to learn how to use your tool is not the best use of their brainpower.

In the Ramp example above, if a customer wants to change a card name, they don’t need to witness how it’s done - they just want it to be completed immediately and effortlessly.

A new paradigm

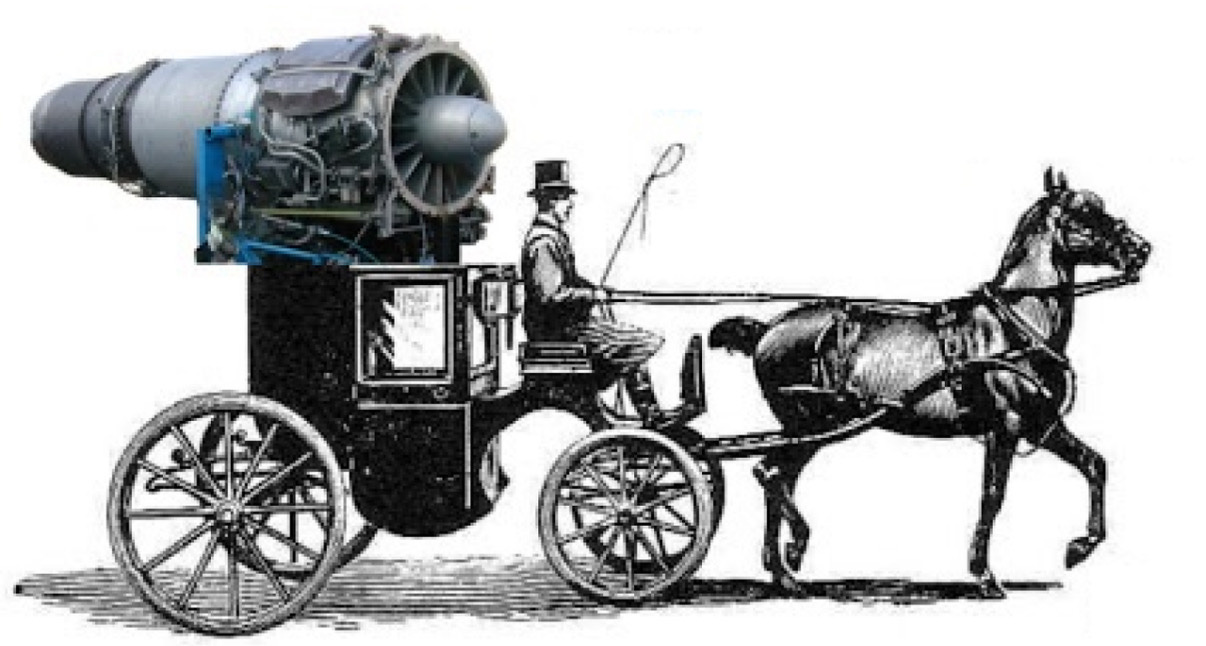

AI isn’t just another tool to strap onto legacy systems. Unfortunately, this is exactly how some banks and fintechs are approaching it - as seen in the Ramp example.

In many ways, this mirrors how “digital transformation” programs were often approached a decade ago, trying to “digitalise” outdated processes that were originally designed for non-digital purposes.

We need to think differently - take a leap and imagine a new future.

Can your product be as effortless as a light switch? With AI, the answer is likely yes.

A common business misconception about the future is that customers will continue to interact directly with your product - opening your app, logging onto your platform, browsing your website. While these interactions might still occur for a while and for certain use cases, I believe in a future where any “boring” task will be outsourced to personal agents.

Remember the movie Her?

Every day, we are getting closer to having personal assistants as capable as those depicted in movies like Her. Whether, in 10 years, people will interact with their agents by voice, text, or even through their minds (hello Neuralink) - we don’t know. But one thing is certain: these capabilities are being built today.

Apple has laid the foundation for Apple Intelligence, OpenAI is working on physical devices, Google is scrambling to reclaim its AI dominance, Microsoft is is embedding Copilot wherever possible, and Meta is doubling down on developing the best AI models out there. Big tech is building AI capabilities at an unprecedented pace.

If you want to learn more about Apple Intelligence, check out this article:

Your personal agent will have your best interests at heart. It will remember everything you share - your preferences, habits, finances, and more. It will seamlessly collaborate with other agents to access knowledge it doesn’t yet have. Working 24/7 without ever taking a day off, it will always be there to assist you.

In workplaces, I can imagine AI agents acting as work buddies - similar to personal agents but optimised for professional tasks. These agents would have capabilities and knowledge tailored for work, accessible through work devices, and the ability to scale certain tasks to entirely new heights.

Jensen Huang, Nvidia’s CEO, even predicts that you may one day be able to “rent” agents by the million.

If a task can be outsourced to an agent, whether for work or personal use, people will gladly do so. Not only does it save time, but it also allows for impressive scalability.

It’s a mistake to assume your customers will want to interact directly with your agents or platforms. It will be their agents talking to your agents.

Will we need banking apps in 10 years? I don’t think so. Today, visiting a bank branch feels inconvenient, time-consuming, and unpleasant. I believe banking apps will eventually feel the same.

Why does this matter?

More than 70% of Gen Z are using generative AI to get things done - an impressive statistic, especially considering that ChatGPT, the most popular generative AI tool, is less than three years old.

In a recent survey, 60% of US consumers reported using a chatbot to help research or decide on a purchase.

Consumer behaviours are changing rapidly. Through agents, consumers will become incredibly savvy. That sneaky term you added in small print on your T&Cs? It will be noticed - and used against you.

How easily can an agent interact with your platform? How effectively can it retrieve, analyse, and act on the data it needs? These questions will define the winners of the next decade.

The implications for banking and fintech are significant. Financial institutions will need to compete on the quality of their agent-to-agent ecosystems. The frictionless exchange of information, secure and efficient APIs, and the ability to provide contextually rich, actionable insights will become the new battleground.

For consumers, this means less effort, more accuracy, and smarter financial decisions. For businesses, it means evolving or risking irrelevance.

The age of agents is here - and it’s transforming everything.

About Dom Monhardt, founder of one-fs.com

I am a French technologist and product leader living in Dubai, with 15+ years of experience in building cutting-edge and innovative digital experiences.

I am interested in the intersection of business, design, and technology and am deeply passionate about the fintech and digital banking world.

I can’t get enough of your newsletter! It’s honestly one of the most thoughtful and well-researched sources I’ve found, and the way you present information makes it so easy to digest. I look forward to each new issue, and I can already tell I’ll be a regular reader from here on out. I subbed.