Why OpenAI’s Life Management Will Make Banking Invisible

The next phase of fintech is about invisible intelligence that knows you.

Hey there! Dom here 👋

This week I’ve been deep in AI experiments - building agents, automating flows, and running everything locally on my 80 GPUs (just flexing a little 😆). It’s been a reminder that the best way to cut through AI hype is to build and see for yourself. If there’s enough interest, I might run a workshop on this soon.

Now, onto something I’ve been thinking about a lot lately: the future of banking.

If you’ve followed me for a while, you’ll know my core beliefs:

Mobile apps will disappear

AI tools will replace apps (your fintech or bank will become a tool)

Operating systems will generate interfaces on demand

The web won’t be visited by humans

Boring tasks will be outsourced to invisible systems

Life will be managed by AI

On-device AI and memory will replace cloud AI for privacy

Some of this may sound far off, but the trendlines are getting clearer every month.

The signal: OpenAI hires the ROI team

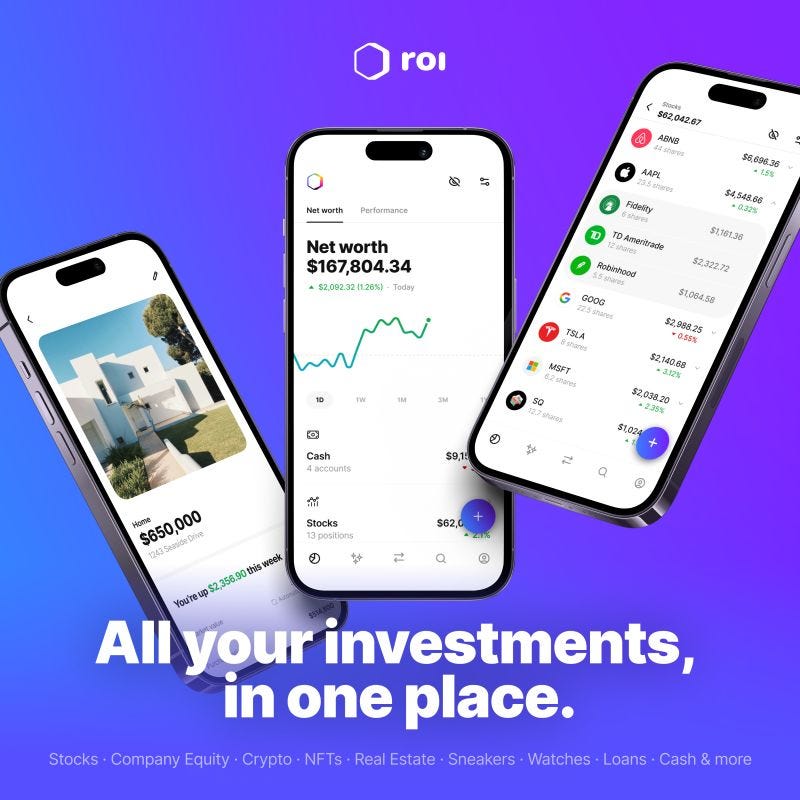

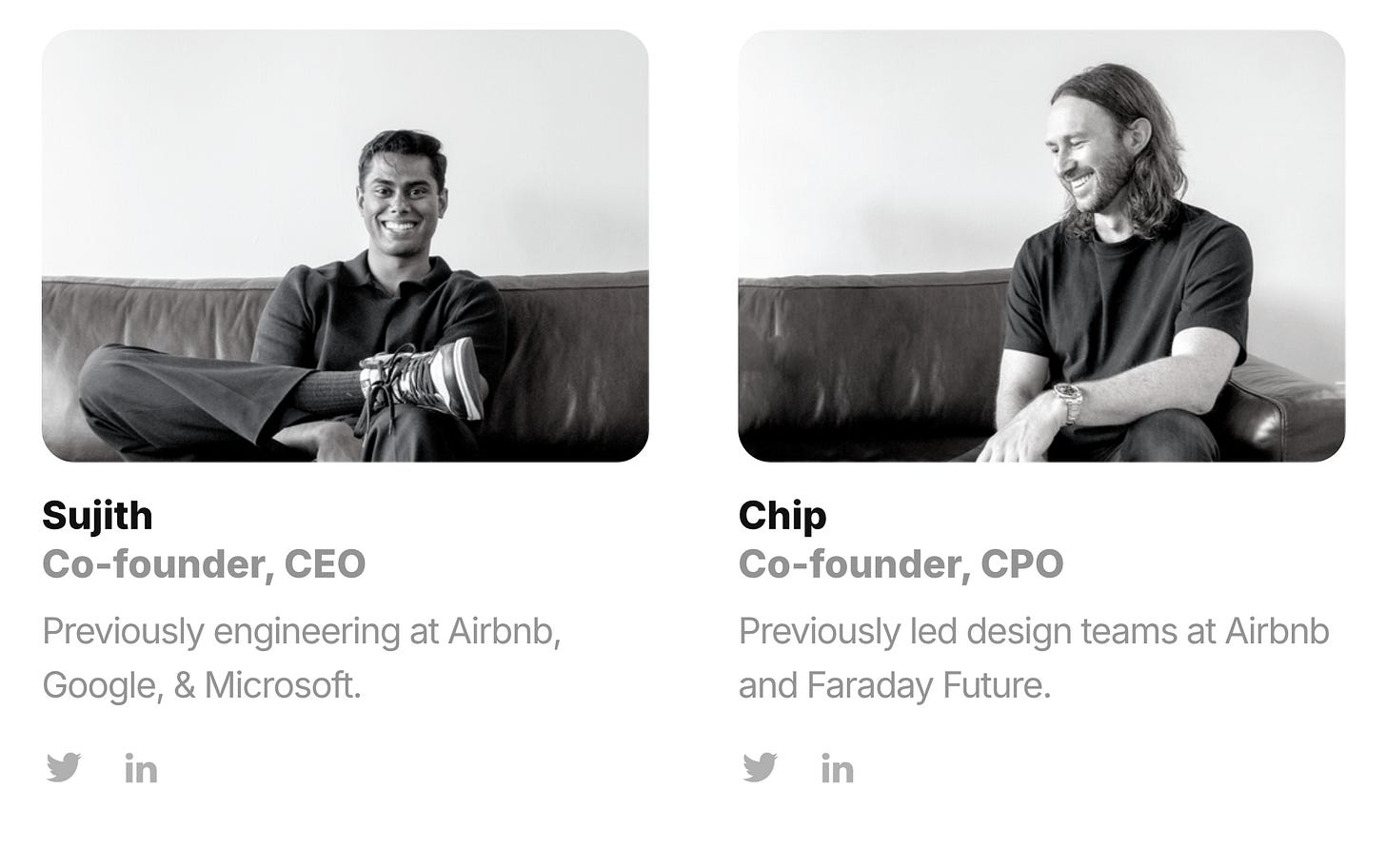

OpenAI recently acquired the team behind ROI, a fintech app that tracked and optimised your net worth. They didn’t buy the product itself, but the people - their mindset, vision, and approach to consumer experience.

Both ROI co-founders came from Airbnb, not finance. That matters.

They weren’t burdened by “how things are done” in banking – exactly the kind of fresh perspective OpenAI values.

ROI had two core features:

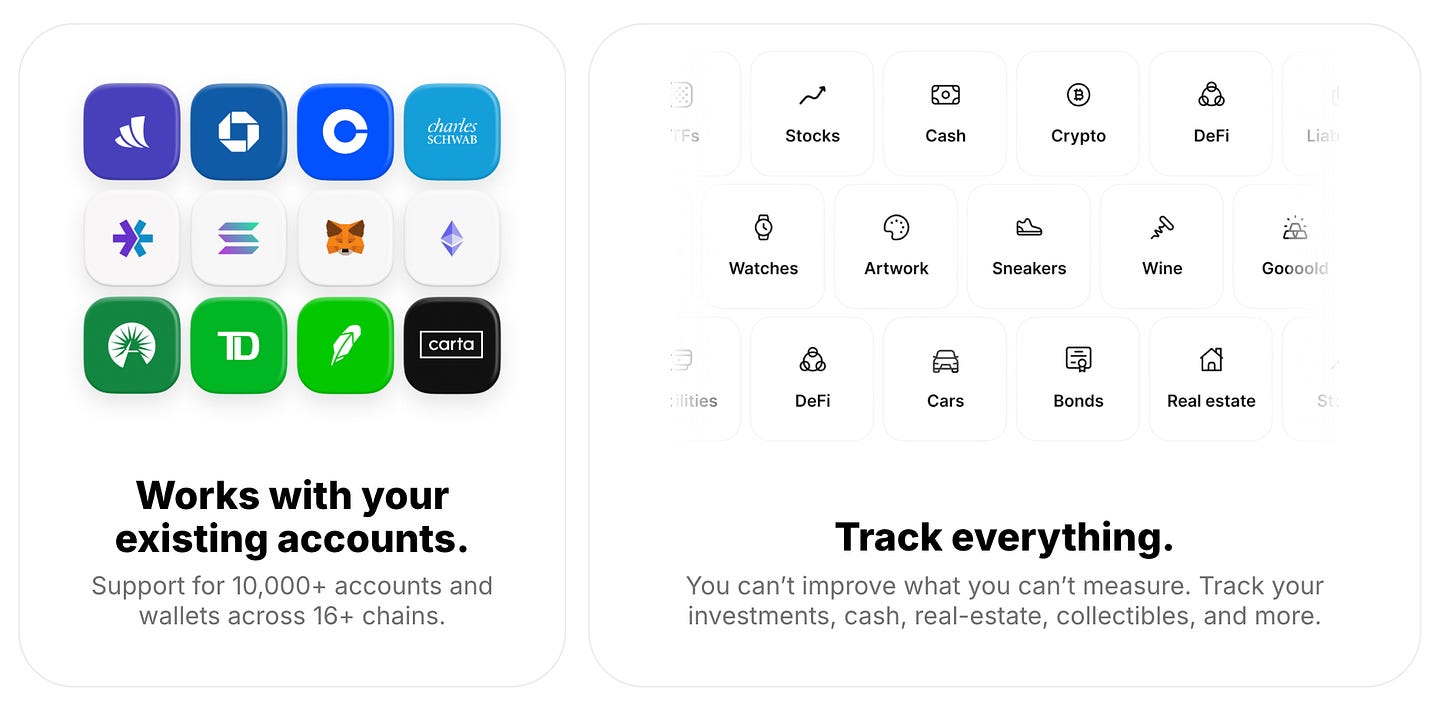

1️⃣ Financial aggregation: connecting banks, fintechs, crypto wallets, and even offline assets like art or collectibles.

2️⃣ Command centre for trading: where users could follow portfolios of investors and hedge funds, with ROI orchestrating trades across brokers.

One app, one interface, all your money.

ROI’s values

Their company values said it all:

We win when you win

We want the best possible outcome for you. Your success is our success.

Remove barriers

Provide access to the knowledge, opportunities and tools needed to reach your goals.

Always private and secure

We treat your data like we want ours to be treated, simple as that

Tailored to you

There is no one size fits all. Roi is built for your financial future, no matter who and what your goals are.

This mindset is gold for what comes next.

OpenAI’s next move: Life Management

OpenAI isn’t just building chat models anymore. It’s quietly assembling the components for Life Management - a layer that connects your data, tools, and goals into an intelligent personal operating system.

To make that work, three things are needed:

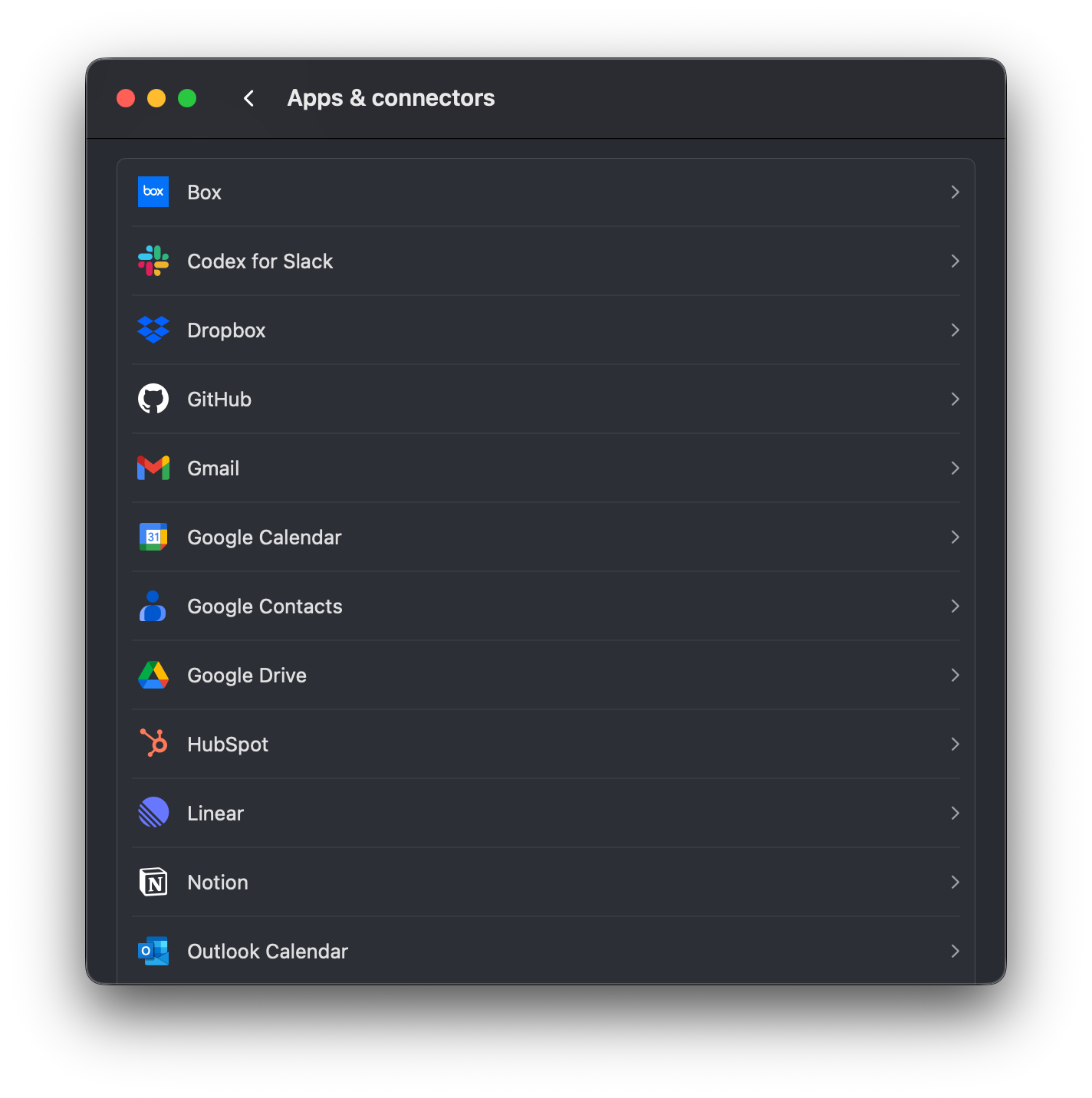

Connected data and tools - integrations across every domain of your life.

Powerful models and agents - to interpret and act on that data.

An AI-first product team - focused on experience, not features.

With ROI’s DNA, OpenAI has strengthened the third piece.

The end of interfaces

In my last piece, I showed how OpenAI has already begun replacing merchant interfaces. ChatGPT now pulls product data directly, handles checkout via its agent, and never sends you to a merchant’s site.

Next will be banks.

Bank connectors and MCPs (like the one I built for Wio) will become standard. Soon, ChatGPT, Claude, and others will embed financial interactions natively - checking balances, transferring funds, or reviewing your portfolio without opening a banking app.

The interface won’t be an app. It will be a conversation.

Financial widgets inside ChatGPT

OpenAI recently introduced UI widgets inside ChatGPT. These allow you to visualise and interact with structured data directly in chat – a big leap beyond plain text.

Soon, we’ll see financial widgets that summarise your net worth, spending, or investments on request.

“Show me my monthly expenses.”

“Invest the leftover cash in my long-term portfolio.”

No bank app. No login screen. Just your assistant handling it.

Financial recommendations as daily dialogue

ChatGPT’s new “Pulse” feature - where it starts your day with a summary - will likely evolve into personalised briefings:

“You’ve overspent on dining this month. Move AED 2,000 from your travel budget to savings?”

“Your mortgage renewal is due next week - here are better rates.”

That’s when banking becomes invisible.

What it means for fintechs

Fintech products will stop being standalone destinations. Instead, they’ll power layers within someone’s personal AI ecosystem. The new competition isn’t who has the best app, but who can integrate most seamlessly into the user’s life management agent.

To stay relevant, fintechs will need to:

Focus on deep integrations, not flashy UIs

Build APIs and orchestration layers ready for AI agents

Prioritise privacy, context, and trust – since AI assistants will hold financial memories

Banking will no longer be a destination. It’ll be a background process that simply works.

What do you think?

If this sparked ideas – or raised questions - I’d love to hear from you. Hit reply or DM me.

Until next time - Dom 👋

About Dom Monhardt, founder of one-fs.com

I am a French technologist and product leader living in Dubai, with 15+ years of experience in building cutting-edge and innovative digital experiences.

I am interested in the intersection of business, design, and technology and am deeply passionate about the fintech and digital banking world.

Would love a workshop🤞