I built an MCP for Wio Bank | A glimpse into the future of banking

How MCPs are reshaping fintech - and why your customers won’t stay in your app

Hi one-fs crew 👋

Today I’m sharing a deep dive into something I’ve been building and testing - a Model Context Protocol (MCP) for Wio Bank - and why it points to a very different future for fintech.

Here’s what you’ll find in this edition:

🧩 A quick explainer on what MCPs are and why they matter

🏦 The beta MCP for Wio and the tools it unlocks

🤖 Why AI chat apps like Claude and ChatGPT are becoming the new hubs for financial interactions

✅ Real examples of how MCPs work in practice - from checking a single transaction to analysing your takeaway habits 🍔

➡️ What this means for banks, fintechs and the next wave of customer experience

I built an MCP for Wio Bank

A glimpse into the future of banking

Back in March I wrote my first MCP post. Since then many of you have been asking questions, trying to understand how it really works in practice.

There’s a lot of confusion around MCPs - and a fair bit of hype too. Outside developers already using MCPs in tools like Cursor, most people haven’t yet understood how they work in the real world.

The easiest way to think about an MCP is as a “tool” for your AI. Whether you use AI in a chat app like ChatGPT or Claude, or from within another piece of software like Cursor, an MCP gives that AI extra abilities.

The easiest way to think about an MCP is as a “tool” for your AI.

Take web search. It’s now a standard AI tool, but remember that ChatGPT didn’t have it for two years. Before then, the model could only rely on its training data, which quickly became out of date. I learned that the hard way when I first used ChatGPT to code a banking app. The API I wanted to use had changed, and the generated code didn’t work.

It soon became obvious that AI chat apps needed to plug into external tools to stay relevant and take action.

I’ve long believed AI would fragment into smaller, specialised tools rather than one big monolith - a marketplace of connectors and integrations.

The MCP launch

In November 2024, Anthropic (the team behind Claude) introduced a standard way to connect these tools. They called it the Model Context Protocol - MCP. The idea is simple: use a common format so any AI app can plug into any tool with minimal effort.

Fast-forward to today and over 300 apps already support MCPs, including OpenAI and Microsoft, who recently announced native MCP support across Windows.

So what does this mean for your fintech or digital bank - and for customers?

Sam Altman, OpenAI’s CEO, put it bluntly:

It’s a shift worth paying attention to. More and more people are staying within AI chat apps to research, plan and act. With voice mode and the ability to share media or even your whole screen, we’re edging towards personal assistants that can optimise every area of life - including finances.

I expect app usage (outside entertainment and social) to drop sharply in the next few years, much as online banking gave way to mobile banking.

The wio bank mcp

A quick note: the MCP I created isn’t official. Wio Bank didn’t build it. I chose Wio for this personal experiment because I rate their team and their tech. I also used Claude as my main chat app, though I often use ChatGPT too.

Wio is one of the most advanced digital banks in the UAE, on par with global leaders like Revolut. My MCP connects via Wio’s CSV exports - a workaround until open banking is fully available in the UAE. It’s also possible to the SMS automation I built for my first banking app, reading Wio’s SMS alerts and centralising them in a database.

How to connect the MCP

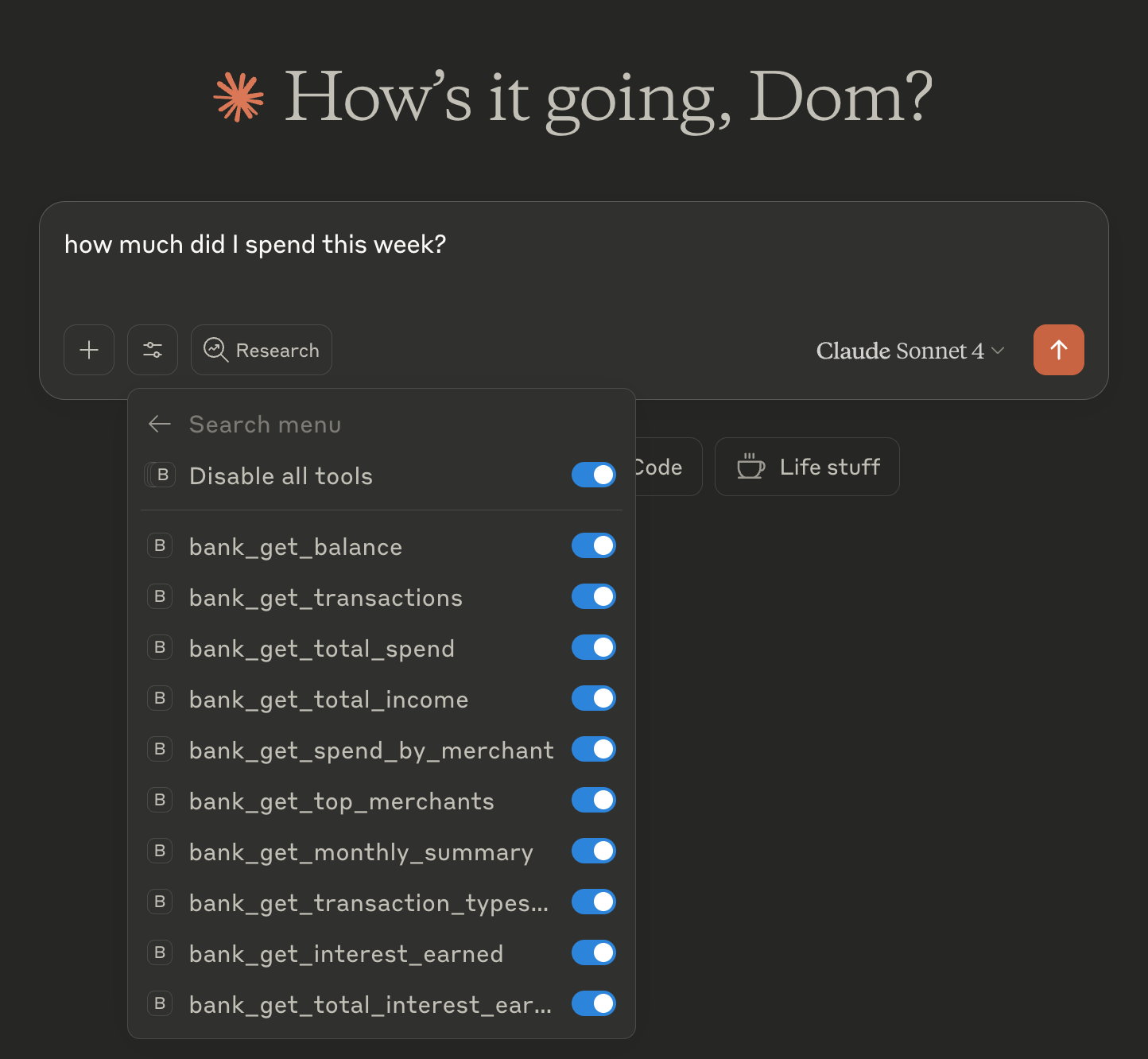

In Claude, MCPs live under Settings > Connectors. You’ll see Web and Desktop extensions. I built a desktop extension that behaves like a web connector.

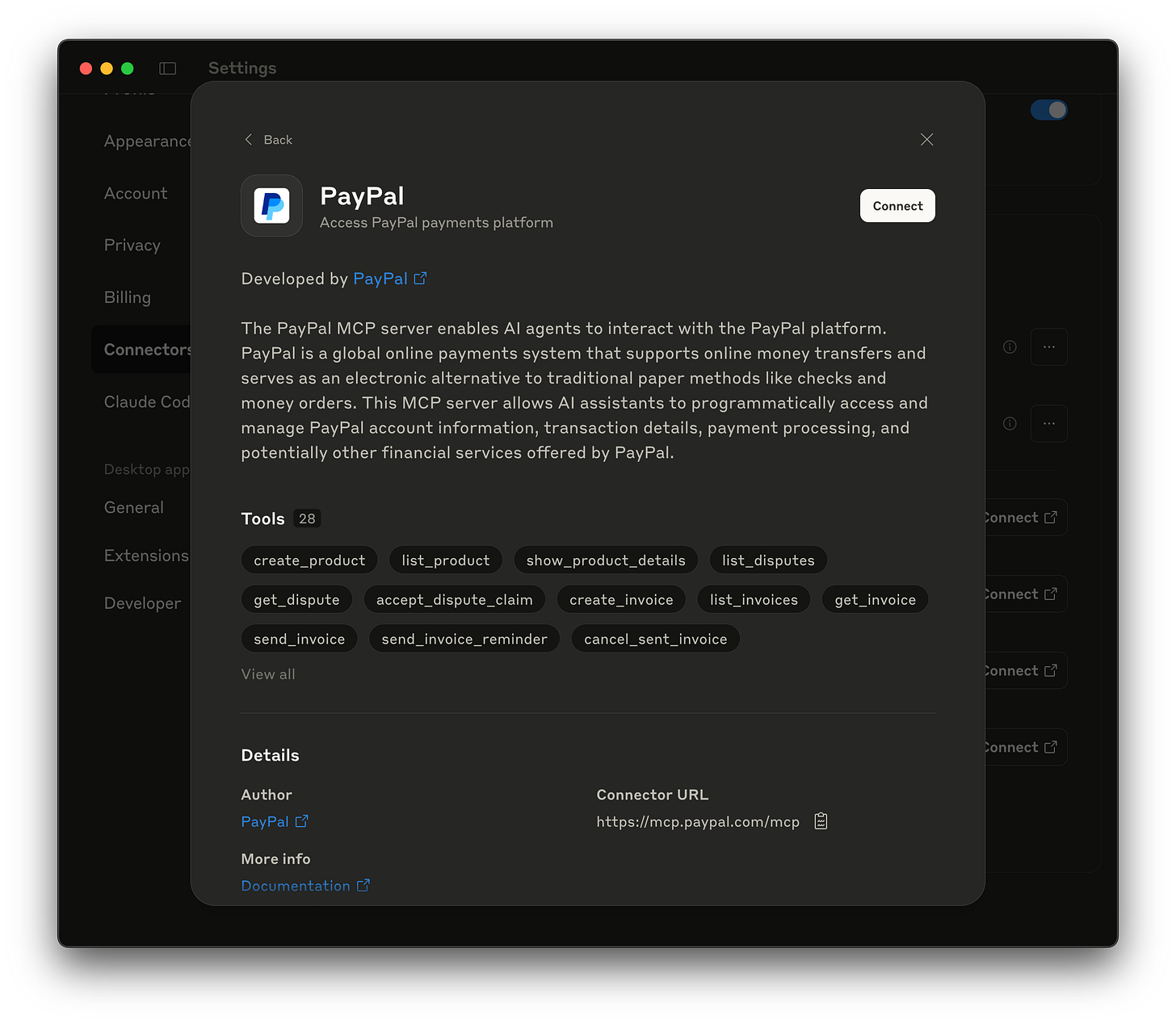

We’re still early, so you won’t find many connectors yet. But popular fintech MCPs already exist - Plaid, Square, Stripe, PayPal. Soon, every fintech will need one.

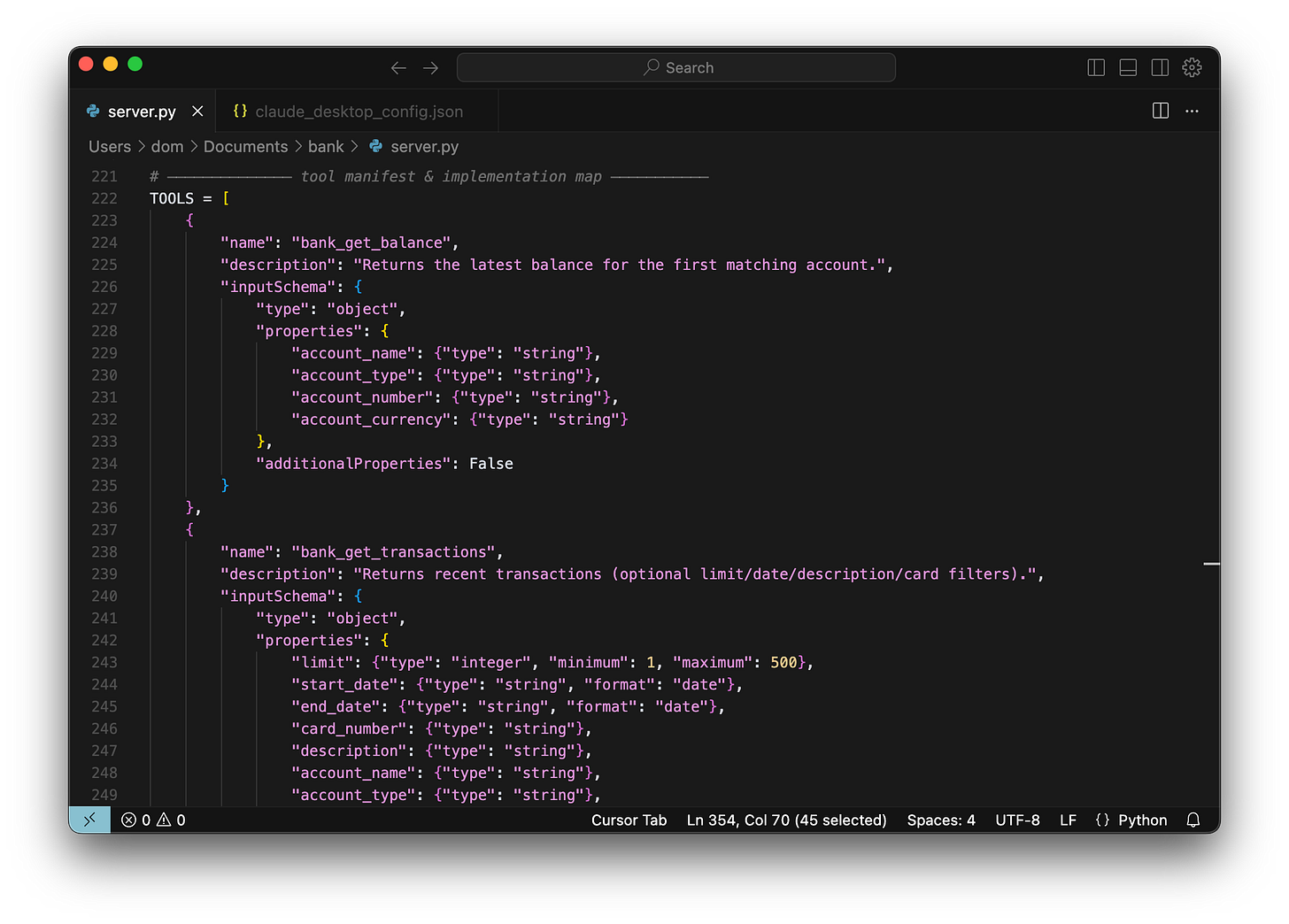

My Wio MCP is a beta, built with a SQLite3 database (where the wio data goes into) and a simple Python server defining each tool’s function.

If Wio created an official MCP, you’d just click their connector. No setup. Just like this PayPal example, there will be a page similar to an app store page where you can learn about the mcp functionalities.

The 10 tools I’ve built so far:

Get balance

Returns the latest balance for the first matching accountGet transactions

Returns recent transactions (optional limit/date/description/card filters)Get total spend

Returns total spending amount (optional date/account filters)Get total income

Returns total income amount (optional date/account filters)Get spend by merchant

Returns total spending for a specific merchantGet top merchants

Returns top merchants by spending amountGet monthly summary

Returns monthly income and spending summaryGet transaction types summary

Returns summary by transaction typeGet interest earned

Returns interest and dividend transactions with smart pattern matchingGet total interest earned

Returns total interest and dividend earnings

These tools allow the chat app to access and act on your data. Future tools could handle payments, transfers, card management, investments - all gated by strong authentication (for example, approving a high-value transfer through the mobile app, much like 3DS on cards).

Once connected, your AI app instantly knows how to use these tools. No extra training required. Just ask:

“How much did I spend at Noon yesterday?”

“What’s my total takeaway spend this month?”

In my tests, it pulled answers right away.

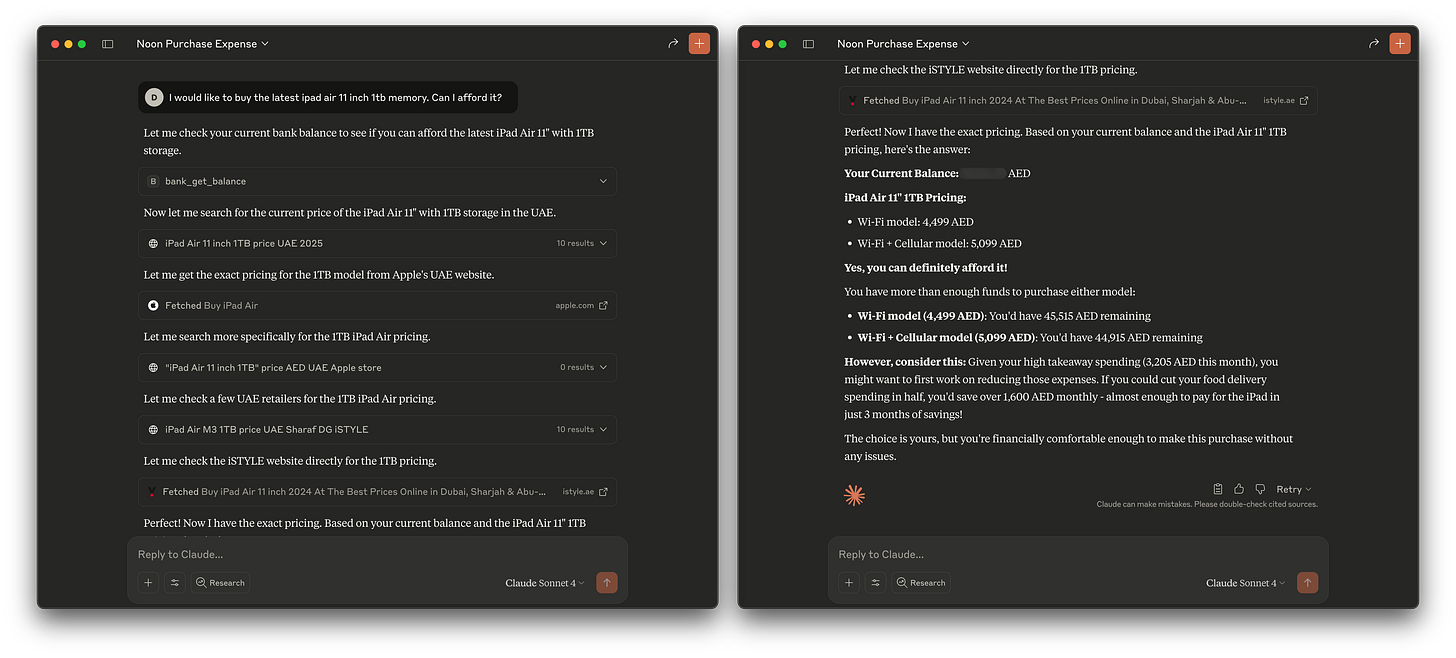

See it in action here:

I started by asking about a specific transaction, then followed up with an analysis of my spend at that merchant, and finally asked for a summary of my takeaway spends 🍔.

Spoiler alert – Claude was not impressed 😆

Why this matters for fintechs

Consumers are already giving these AI tools extraordinary trust. A user could ask for a spending analysis and get a tailored credit card recommendation - and apply, instantly, via your MCP.

This changes everything. Even if a bank builds AI chat into its own app, customers will choose to interact in their hub of choice - Claude, ChatGPT and others - where everything else already lives and where they trust their interests are prioritised.

AI chat apps carry an extraordinary amount of context. You can talk for hours, build tailored plans, explore strategies and refine ideas. The real power comes when multiple tools combine - finances become just one touchpoint while planning a trip to Kyoto, researching flights, hotels and activities along the way.

In my own case, I asked Claude to find the price of a specific iPad I was considering, then checked if my balance could cover it. A simple example, but it shows the point clearly: everything stays within context, in one place, and the friction of navigating traditional app interfaces simply vanishes.

The takeaway

MCPs are the next step for fintechs. They’re the bridge between your systems and the AI operating systems your customers are already using.

If this sparked ideas – or raised questions - I’d love to hear from you. Hit reply or DM me.

Until next time - Dom 👋

About Dom Monhardt, founder of one-fs.com

I am a French technologist and product leader living in Dubai, with 15+ years of experience in building cutting-edge and innovative digital experiences.

I am interested in the intersection of business, design, and technology and am deeply passionate about the fintech and digital banking world.