N26 vs Stables | How to Onboard in 2025

Why new players are outpacing digital banks at their own game.

Hi one-fs crew 👋

It was another busy week in the fintech and digital banking world! Money20/20 took over Amsterdam with the usual flurry of product launches, partnerships, and bold predictions - plus 150 banks, a Formula 1 car, and even a few LEGO sets up for grabs courtesy of Visa. Hot topics this year: real-time payments, AI in financial services, and stablecoins edging closer to the mainstream.

Here are 5 quick highlights from the event:

Deutsche Bank x Mastercard - launching ‘Pay by Bank’ across Europe with real-time open banking payments.

BVNK x LianLian Global - stablecoin payments for merchants in 100+ countries, with near-instant settlement.

Revolut x Wero - adding support for the European wallet Wero, starting in France, Belgium and Germany.

Klarna x Visa - a new debit card that lets you pay now or later at 150M+ Visa merchants.

FIS x Episode 6 - unveiled its International Issuing Hub to help banks modernise faster.

Uber x Stablecoins

Elsewhere, some interesting announcements popped up - including Uber’s foray into stablecoins. As a global business operating in 70+ countries, the move makes total sense from a treasury ops perspective. Just three months ago, the company was under fire for charging riders in local currency - but quietly adding a 1.5% “convenience” fee for currency conversion.

But switching to stablecoins isn’t just a back-office win. The real impact will be felt by gig workers who can now get paid instantly (instead of waiting 2–3 days), and it opens the door to a stablecoin checkout option for riders. With 161 million active users, these changes will make a difference - and other super apps will be watching closely.

Catchup

AI, stablecoins… nothing new for the one-fs reader. We’ve been covering these themes long before they hit the mainstream. If you’ve missed any of it, here are a few past reads worth revisiting:

N26 vs Stables | How to Onboard in 2025

This week, I put two very different onboarding experiences to the test. I signed up with N26, one of Europe’s leading digital banks, and Stables, a crypto-native alternative built around stablecoins. Traditional fintech vs. the new wave.

Both claim to be simple, fast, and user-friendly - but the reality tells a more nuanced story. Here’s what onboarding looks like in 2025.

Stables: how to onboard in 30 seconds ⚡️

I expected fast – but not that fast.

Technically, the whole thing including KYC took a bit more than 30 seconds. But honestly, I felt onboarded by second 30, and that’s what really matters.

Here’s how the sign up went:

Download the app

Tap “Get Started” & enter mobile number

Verify mobile (code via SMS or WhatsApp)

Enter email

Allow Face ID (no password here)

Turn on notifications (optional)

The app feels smooth, fast, and the micro-interactions are delightful 🤩

The key strength Stables has nailed here is early gratification - something you’ve heard me talk about before. Get the user a sense of accomplishment, fast. It doesn’t matter if they can’t do much right after that first milestone. This is about perception. A strong first impression implies the rest of the journey will be just as easy - no headache, no second guessing.

And since you’re really just creating a user account at this stage, there’s not much to ask for beyond contact details.

No legal jargon 𐄷

There were no legal disclaimers interrupting the flow. It’s all on the website, clearly stating that by downloading and using the app, you accept the terms. Clean and frictionless.

No outdated password policy 🔒

It’s refreshing not to be hit with the usual bank password ritual. A good next step would be supporting passkeys – but leveraging device biometrics is already a great move.

Cool look and feel 👌

Gone are the days of shady Web3 apps filled with jargon and dark-web aesthetics. Stables is slick – large fonts, colourful animations, and a tone that signals this isn’t a boring banking app. It’s something you’ll actually enjoy using.

Nanomoments 🐟

They say Gen Z has the attention span of a goldfish – 8 seconds, to be exact. A short, snappy signup flow fits perfectly. Users don’t have to worry about losing progress; they instinctively know they can leave and pick up later.

Read how I’ve used this strategy before when concepting the Middle East’s first digital bank.

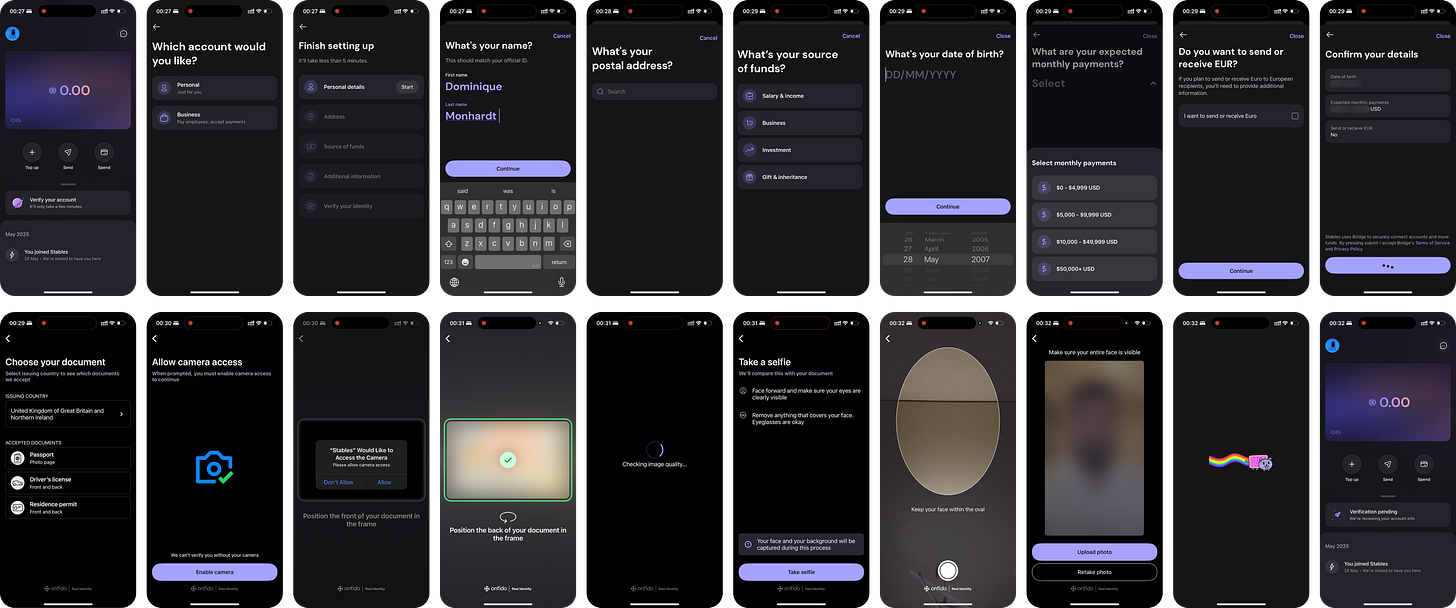

Stables KYC process: “Verify your account”

Now that the user feels comfortable, the serious part can begin.

Stables follows a bank-like KYC process, but they’ve broken it down into 5 clean steps after you select whether you’re opening a personal or business account:

Enter personal details (first & last name)

Enter address (with Google Maps auto-complete)

Enter source of funds

Add a few extra bits (date of birth, expected monthly payments, and whether you plan to send or receive euros)

Verify identity (powered by Onfido - upload official ID, front & back, and take a selfie)

It took me around 5 minutes – mostly because, like Gen Z, I also have the attention span of a goldfish and got distracted midway 😅

Realistically, with only two fields to type (first & last name) and three pictures to take (ID front, back, and selfie), this can be done in under 2 minutes.

What Stables got right

The account setup screen is spot on. It clearly outlines the 5 steps required to activate your account. Starting with your name isn’t just logical - it’s strategic. It gives the user another quick win, reinforcing the feeling of progress from the first tap.

Using Onfido for identity verification is also a smart choice. It just works - and it works globally. With support for over 2,500 document types across 195 countries, it’s ideal for an international user base.

Sidenote: Stables uses Stripe-owned Bridge to issue virtual USD and EUR accounts - another sign they’ve made thoughtful infra choices under the hood.

Even though the onboarding is already supah fast, there’s still room to shave off a few seconds. For example, entering your name or date of birth feels redundant - both are already on your official documents and could be auto-filled via document scanning.

All in all, Stables is definitely on the right track to delivering on their promise: “The stablecoin account replacing your bank.”

Now let’s see how the legit bank stacks up in comparison ⬇️

N26: 25 minutes of hardship 😓

They say a picture tells a 1000 words. So here’s the picture:

If you don’t know N26, it’s one of Europe’s leading digital banks, valued at around $9 billion. With over 5 million users, they reached profitability last year with roughly €440 million in revenue.

Now, as you can probably tell from the screenshot - with around 80 steps and a good 25 minutes to get through - the onboarding felt… draining. To be fair, starting with Stables first probably didn’t help. 😅

But that’s exactly the point. A new wave of financial solutions is emerging - like Stables - setting fresh expectations for what onboarding should feel like. Sure, Stables probably won’t win first place at the compliance awards. I’m sure more checks will be layered on as they expand and roll out more features.

I won’t break down N26’s onboarding step by step - you can zoom into the screenshot or DM me if you want the full play-by-play. But it’s not the journey I’d recommend.

Yes, N26 gives you a fully fledged bank account, and to some extent, it’s not a fair apples-to-apples comparison with a stablecoin wallet. But from a user’s perspective, those comparisons will start happening.

Stables is a great example of a new kind of challenger - one that’s now disrupting the banks that once disrupted traditional banking. A new era is clearly taking shape.

Thanks for reading. Hit reply if you’ve got thoughts – or DM me here if you’re on the web.

About Dom Monhardt, founder of one-fs.com

I am a French technologist and product leader living in Dubai, with 15+ years of experience in building cutting-edge and innovative digital experiences.

I am interested in the intersection of business, design, and technology and am deeply passionate about the fintech and digital banking world.