🌊🏄♂️Vibe Finteching: How AI Is Reshaping Who Builds What

What happens when everyone becomes a builder 👨💻

Hey one-fs gang! Hope you had a great week.

You’ve heard of vibe coding (if not open this in a new window) - the idea that with the right AI tools, anyone can build software by describing what they want.

But something bigger is about to happen: people building financial tools, workflows and even banks.

Scary, right?

In this article, I explore how vibe coding is bleeding into fintech - from personal experiments to full-on financial automation. We’ll look at the rise of user-built apps, the growing need for open APIs, why aggregation platforms like Micro matter, and what fintech leaders should be doing before they get worked around.

I’ll be at the Dubai AI Festival - Come say hi!

9 days to go! The Dubai AI Festival will take place on 23–24 April at Madinat Jumeirah in Dubai.

➡️ There’s only a few passes left with a special one-fs discount with code ONEFS15

🌊🏄♂️Vibe Finteching: How AI Is Reshaping Who Builds What

8 years ago, I helped building the first digital bank in the Middle East. The engineering team was over a dozen people and it took a year to ship the first version.

Two years ago, I built a personal banking app over a weekend and on my own using ChatGPT.

Last week, I built a Mac app in under 10 minutes 👨💻⚡️

Things get democratised. That’s just what we do as humans. When the need is obvious, people figure out ways to make it mainstream - and it just happens with everything.

When I learned design 20 years ago, it was something rather niche, even in a country like France with a deep creative heritage. In Paris, many of us in design knew each other, or at least knew someone who knew the others - whether they came from Les Gobelins, Estienne, or Penninghen. It was a small world, and if you weren’t trained, you probably weren’t doing any design at all, it was something left to the designers.

But design got democratised over the years.

First, people started doing horrendous cliparts in Word but slowly, new tools came out with the ability to make things less ugly with ready-made templates and tools with direct manipulation that doesn’t require years of training.

I remember designers laughing at Canva, a design tool for non-designers (“this thing is a toy!”). Far from being a toy, the platform turned millions of non-designers into creators (220 million monthly active users today).

Meet the builder-user

The same thing is now unfolding with code.

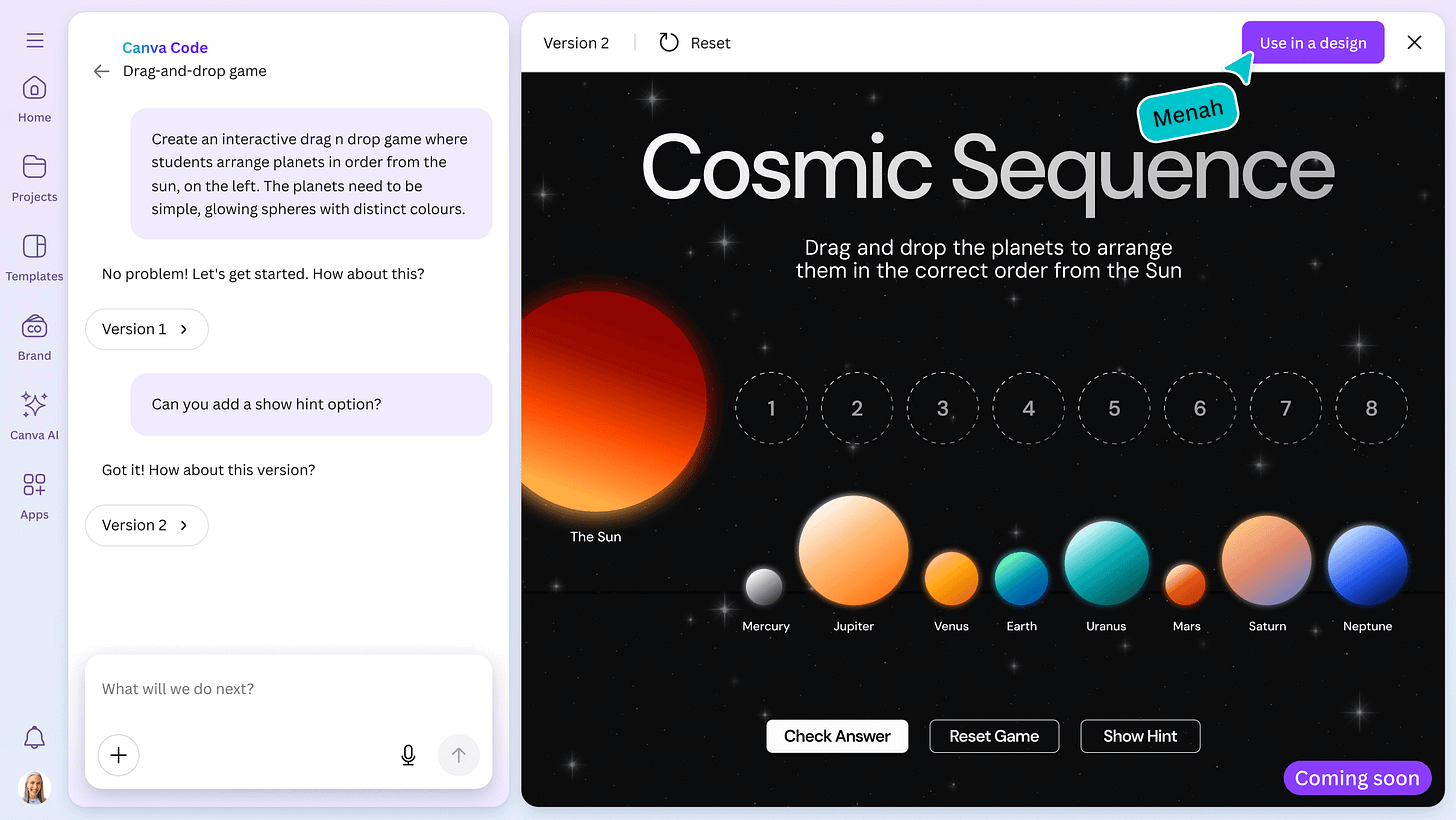

This week, Canva, announced Canva Code. It allows creators to generate dashboards, web apps, tutorials and interactive content through natural language prompts. You describe what you want, and Canva handles the logic, design, and deployment.

It’s a signal.

If the company that democratised design is now coming for software, it means the tools have caught up. You no longer need to know how to build - just what you want to exist.

And with that, we’re seeing a new class of users: the builder-user.

Tools like Lovable, Replit, v0 and Manus are also accelerating this. Lovable calls itself a “superhuman full stack engineer” that lets you go from prompt to production-ready app in minutes. Manus handles even more - generating, testing, deploying, and hosting entire applications from a single instruction. Replit now has over 30 million users, and with its Ghostwriter assistant, even beginners are building software by chatting, not coding.

This isn’t theory. I’ve seen it firsthand. Two years ago, I used ChatGPT and some Python to consolidate my bank SMS notifications into a single personal finance dashboard. It took a weekend and a fair bit of back and forth. Last week, I built a Mac utility to automatically sort and categorise my personal files - in under 10 minutes. Far less debugging, cleaner code, and it ran properly on first build. That felt like a jump in capability, not iteration.

There’s a lot of AI noise right now, and it can feel disconnected from people’s day-to-day. But the change is happening. Just this month, I’ve seen friends with 0 coding background present me with fully working web apps. No courses. No tutorials. Just an idea and a prompt. That was a moment of realisation for me - this isn’t about future potential. It’s already happening.

The great financial aggregation

Which brings us to fintech.

Because once users can build their own tools, they stop waiting for product updates. They stop asking for features. They start solving things themselves. We’ll start seeing a rise in personal fintech stacks - reconciliation tools, auto-transfer bots, AI-powered spend summaries, all created outside the walls of traditional providers. They’re powered by APIs (opened or private), glued together with GPT, and shipped by users who wouldn’t dared open a terminal window.

And the next wave? Aggregation.

There’s growing momentum in the AI community around tools that can offer a complete view - across data, tasks, platforms, and money. One recent example is Micro.so, a platform aimed at stitching everything together using AI. The logic is simple: once creation is solved, the next step is context.

A 360° view across personal systems, including financial data, is no longer a luxury. It’s becoming a basic expectation. From net worth tracking to cash flow forecasting, spending analysis to reconciliation, aggregation is the unlock.

Yes tools like Monarch (no relation!), YNAB or Kubera already exist - along with a growing list of open banking aggregators like Tink, Plaid or Lean in the Middle East. But just as chatbots existed before ChatGPT, these are about to see significant growth.

It will become a hygiene factor. Institutions that offer APIs - especially “expert APIs,” like Robinhood did with Cortex for investor research - support open standards, and build composable infrastructure will thrive.

You can already see this unfold with things like MCP (Model Context Protocol) - a standard that enables AI models to interact directly with financial APIs and instantly become expert about your products / services. It’s what I’ve called USB-C for finance. MCP removes the friction. If your service is compatible, AI agents can start pulling in data, performing actions, and generating insights - in milliseconds.

If you want to learn more about MCP, this article is worth checking out 👇

Business users will be the first to benefit. The ones managing complex data workflows or financial ops already feel the pain of disconnected tools. But consumers won’t be far behind. The appetite for clean, consolidated, intelligent views of money is there - it just needs the right interfaces.

And the interfaces are coming.

Fintechs need to prepare for a new type of user. One who doesn’t request features but writes their own logic. One who doesn’t ask for integrations but expects endpoints. And one who is increasingly comfortable having a conversation - not with their bank, but with the agent that’s building their own version of it.

We used to think of engineers as the builders. Then it was product teams. Now, the user is becoming the builder. That’s not a risk to fintech - it’s the biggest opportunity we’ve seen in years.

All you have to do is open the door. And let them build.

📘 Dom’s reading list: The Worlds I see by Fei-Fei Li

This week I read The Worlds I See by Fei-Fei Lim, it’s a superb book for anyone working in AI or just trying to make sense of how we got here.

With nearly 30 years in the AI field, Fei-Fei shares her journey as an immigrant who arrived in the US with nothing, helped run her family’s dry-cleaning business, and somehow ended up building the foundations for modern AI with ImageNet - one of the cornerstone projects in advancing computer vision and deep learning research.

It’s a story about resilience and pushing boundaries. It’s fascinating to hear how she got ImageNet off the ground, an idea too ambitious for anyone else, shut down by almost everyone. She kept going and eventually, cracked it by using Mechanical Turk to crowdsource 15 million labelled images - a move that changed the trajectory of AI research forever.

There’s plenty of AI history too, including details about how French Scientist Yann LeCun (now Chief AI Scientist at Meta) first applied computer vision in the 1990s to help the US Postal Service read handwritten ZIP codes. One of the first concrete use of AI vision.

It’s also one of the few books I’ve read that deals seriously with the emotional side of building things: doubt, stress, family illness, personal compromises. She doesn’t romanticise the work, she tells the real cost.

Every AI scientist today is standing on the shoulders of giants. Fei-Fei is one of them.

Highly recommend.

About Dom Monhardt, founder of one-fs.com

I am a French technologist and product leader living in Dubai, with 15+ years of experience in building cutting-edge and innovative digital experiences.

I am interested in the intersection of business, design, and technology and am deeply passionate about the fintech and digital banking world.

If you’re in fintech and not planning for users to outbuild you, you’re already behind.

It's a revolution, and we are in the middle of it!