What 2025 Made Clear

The ideas that quietly shaped where fintech is heading

Looking back at 2025, through the ideas that stuck

The end of last year was intentionally slower for me.

I spent time on personal projects, stepped away from the usual pace, and enjoyed proper family time over the holidays. Coming back to one-fs, I reread what I wrote in 2025 with a bit of distance.

What stood out was not which posts did well, but which ideas kept resurfacing. The same themes appeared again and again, often from different angles, and in hindsight they describe a fairly clear direction.

This post is a short recap of those ideas.

PS: I’ve temporarily removed the paywall of all 2025 posts, so you can safely click on any link and enjoy its content 🙂

AI agents quietly became the interface

At the start of 2025, most fintech conversations were still framed around apps, features, and screens.

At the same time, AI systems were getting better at understanding intent and executing tasks. That raised a simple question I kept coming back to: if an AI can do the work, why should the user still navigate the interface?

That thinking showed up across several posts:

AI agents handling actions, not just answers

Banking interactions shifting from flows to conversations

Products needing to be operable by machines, not only humans

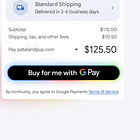

Over the year, this stopped sounding abstract. Agentic checkout, task execution, and conversational finance began to ship in real products.

The implication remains straightforward: products that cannot be used by an agent will feel increasingly indirect.

MCPs became plumbing, not a talking point

When I wrote about Model Context Protocols and experimented with one for Wio, MCPs were still unfamiliar to most teams.

The focus at the time was on prompts and chat interfaces. Less attention was given to how AI systems would safely call real banking functions, or how financial products should expose structured, permissioned capabilities.

That gap closed quickly.

By the middle of the year, MCP-style integration became the expected way to connect AI to action. Not because it was trendy, but because it was necessary.

This reinforced a recurring belief of mine: meaningful experience changes usually follow infrastructure change, not UI refreshes.

Stablecoins shifted from concept to utility

Stablecoins were another theme that evolved quickly over 2025.

Early discussions often treated them as experimental. As the year progressed, they showed up in places that mattered: Stripe’s acquisition of Bridge, Shopify enabling stablecoin payments, platforms using them for settlement and cross-border flows.

What became clear is that stablecoins work best when they fade into the background.

They are useful because they reduce friction, speed things up, and make certain products possible. Once they do that reliably, they stop being a headline and start being infrastructure.

Onboarding and growth made expectations visible

Comparing onboarding experiences like N26 and Stables highlighted something that is easy to overlook.

Users do not compare you to your direct competitors. They compare you to the fastest, cleanest experience they have had anywhere.

The same applies to growth mechanics.

Revolut’s referral engine works because it is part of the product, not an add-on. It is designed, measured, and iterated like any other core capability.

These examples reinforced a simple idea: onboarding and growth are product problems before they are marketing problems.

Design still matters when everything gets automated

One of the quieter pieces I wrote last year focused on Jony Ive and the idea of building with care.

It felt important to include that perspective alongside all the discussion about AI, protocols, and automation. As products become more invisible and agent-driven, it becomes easier to lose intentionality.

Trust, clarity, and care are still felt, even when no one is tapping through screens.

Possibly even more so.

Where this leaves me going into 2026

Looking back, 2025 helped clarify a few things for me:

Interaction is shifting from navigation to intent

Infrastructure decisions shape experience more than most design choices

AI becomes useful when it can act, not just analyse

Programmable money enables new product categories

Care and craft do not disappear in automated systems

Most of what I wrote last year was an attempt to make sense of changes as they were unfolding, rather than reacting once they were obvious.

That’s still the goal for one-fs.

More soon.

If this sparked ideas – or raised questions - I’d love to hear from you. Hit reply or DM me.

Until next time - Dom 👋

About Dom Monhardt, founder of one-fs.com

I am a French technologist and product leader living in Dubai, with 15+ years of experience in building cutting-edge and innovative digital experiences.

I am interested in the intersection of business, design, and technology and am deeply passionate about the fintech and digital banking world.